NEWS Feed

DragonEx will introduce tokenized quotas for the withdrawal of crypto assets

10/11/2020

Singapore-based cryptocurrency exchange DragonEx will temporarily introduce tokenized withdrawal quotas for digital assets as part of addressing current issues.

Marketplace users will receive DragonEx Withdraw Quota (DWQ) tokens. 1 DWQ will allow you to withdraw one asset from the platform, the cost of which is 1 USDT. To receive DWQ, clients need to trade on the exchange, borrow assets or make deposits. When requesting a withdrawal, an equivalent amount in DWQ will be debited from the user’s account.

DragonEx management said that this is only a temporary solution that will help the exchange cope with its current problems. Recall that on October 21, DragonEx announced the suspension of the deposit and withdrawal of digital assets due to a “crisis of confidence” of users in centralized sites amid problems with the OKEx exchange.

OKEx halted the withdrawal of cryptoassets last month after one of the private key holders was unavailable due to an investigation by Chinese law enforcement agencies. DragonEx executives said that after the OKEx “incident”, users lost confidence in exchanges and began withdrawing funds, which negatively affected DragonEx’s operations.

Earlier, the exchange announced the development of a restructuring plan to restore the withdrawal function and did not even exclude the possibility of its closure if it had not been able to carry out the reorganization before November 2. In a recent address to users, DragonEx management said it is looking for outside investment, but it takes time.

DragonEx plans to gradually restore asset stripping. To make this process “less painful”, it was decided to temporarily introduce tokenized quotas. As soon as the exchange becomes profitable again, the site will destroy all DWQ tokens and restore the normal withdrawal function.

Microsoft employee got nine years in prison for bitcoin fraud

10/11/2020

A Microsoft employee who used data from colleagues to scam bitcoin and various gift cards received nine years in prison.

26-year-old Ukrainian Vladimir Kvaschuk lived in Washington and worked at Microsoft from August 2016 to June 2018. He used the personal data of colleagues to steal and then resell various gift cards.

Kvashchuk transferred his profits to Bitcoin and used mixing services to hide the origin of the funds. After that, the cryptocurrency was exchanged for US dollars and transferred to Kvaschuk’s accounts. The damage from his actions amounted to $ 10 million.

Interestingly, Kvaschuk even reported to the US Internal Revenue Service (IRS) that he received bitcoins. True, in his tax return, the criminal indicated that a relative gave him the cryptocurrency.

This is the first Bitcoin and tax fraud case in the US, according to IRS Special Agent Ryan Korner. He noted that now the IRS has all the necessary competencies to track cryptocurrencies:

“Simply put, today’s verdict shows that you cannot steal funds over the Internet, channel them through Bitcoin and think that it covered up your crime.”

Kwashchuk was found guilty of 18 federal violations, including six cases of money laundering and two cases of filing false tax returns. With the funds received, a former Microsoft employee bought a house on the lake for $ 1.6 million, as well as a Tesla electric car for $ 160,000.

OKEx announced the involvement of lawyers to solve the problem with the withdrawal of cryptoassets

09/11/2020

Cryptocurrency exchange OKEx announced the involvement of third-party legal consultants to solve the problem with the withdrawal of digital assets.

Recall that on October 16, the exchange suspended the withdrawal of cryptoassets due to the “unavailability” of one of the holders of private keys. OKEx CEO Jay Hao explained that the lack of a key holder is due to an investigation by Chinese law enforcement authorities against this person, but it has nothing to do with the exchange.

Then, on November 6, the OKEx management announced that they had contacted other private key holders, but could not disclose details due to the confidentiality of the investigation. The report also said that the trading floor staff were facilitating the investigation and cooperating with the police department.

Some media reported that the founder of OKEx Star Xu was detained, but the exchange representative denied this information. OKEx executives called it “rumors” that a criminal charge was being brought against the detained holder of the private keys. The exchange also denies rumors that it stores clients’ assets in a cold, one-signature wallet.

In addition, the OKEx management has assured users that their funds are safe and that the site is operating as usual. The representatives of the exchange explained that they are making every necessary effort to restore the withdrawal of funds in the near future.

As a reminder, in September, Chinese investigating authorities began investigating the activities of an OTC cryptocurrency trader who helped scammers exchange $ 73,500 for USDT. Funds are assumed to have been deposited with OKEx first.

DeFi developer PercentFinance error leads to $ 1 million freeze of crypto assets

09/11/2020

Due to a mistake by the developer of the DeFi PercentFinance application, a fork of Compound Finance, 446,000 USDC, 28 WBTC and 313 ETH were frozen, the total value of which exceeds $ 1 million

The DeFi platform team PercentFinance wrote in a blog post that “there is a problem in some money markets that could lead to permanent blocking of users’ assets.” The team froze money markets for USDC, ETH and WBTC.

A total of 446,000 USDC, 28 WBTC and 313 ETH are frozen, equivalent to roughly $ 1 million. According to a blog post, half of these assets are owned by the “community development team” PercentFinance. The withdrawal of money from other markets is open, but the team urges users not to take out loans in any of the PercentFinance markets.

In a Discord discussion of the vulnerability, Ethereum developer and PercentFinance Vfat said that another developer who forked PercentFinance from Compound Finance “used old Compound contracts instead of … newer, much better versions.”

Vfat has begun updating some of these smart contracts, in particular the platform’s lending interest rate regulation. After Vfat completed the changes and deployed them, it realized that the signatures for the old and new contracts were incompatible, so no transactions could be signed with them.

“The old and new interest rate models have different signatures for all of these important features,” he said in a Discord chat. “Basically, the token contract is trying to find an interest rate function that doesn’t work, so it fails on every interaction.”

According to Vfat, “The Compound team has confirmed that this means a contract lock.” He noted that it is too early to talk about an asset recovery plan, as the protocol developers have not yet communicated with Center or BitGo – issuers of USDC and WBTC, respectively.

In theory, USDC and WBTC issuers could blacklist addresses with blocked assets. After being blacklisted, BitGo and Center could re-issue new tokens to the old owners, which Tether did for a trader who mistakenly transferred 1 million USDT to the wrong address.

A Center spokesman said the company can only interfere with USDC transactions if it receives “a valid, binding order from a competent US court that has authority over Center.”

Regarding other recovery efforts, Vfat said one early-stage proposal involves the launch of new contracts for the USDC credit markets. Although 27% of loans are fixed in the old contracts, the new contracts will allow borrowers to pay off the remainder of their loans, thus obtaining their collateral and paying the lenders $ 0.73 cents on $ 1. At the same time, there are no opportunities to return the ETH blocked in the contract.

“Regardless of what happens next, I take responsibility for the lost assets and will do everything in my power to recover the losses,” Vfat said.

Blockstream Developers Introduce New Multisignature Option for Bitcoin

06/11/2020

Bitcoin is gearing up to roll out support for Taproot privacy technology and Schnorr signatures. Blockstream developers have introduced a new version of MuSig2 multisignature transactions.

In a blog post, developers Jonas Nick and Tim Ruffing have proposed a new MuSig2 multisignature transaction scheme. It should reduce the technical complexity of multi-signature transactions while maintaining the privacy of the parties to the transaction.

The proposed multisignature scheme takes the best from the previous methods. The older version, called Checkmultisig, requires less interaction between participants, but provides a lower level of security and anonymity. Modern MuSig1 offers a better level of anonymity, but requires more interactions to confirm a transaction.

MuSig2 will provide the same level of anonymity and security as MuSig1, but will reduce the number of participant interactions to two. MuSig2 can also improve the privacy of the second level Lightning Network solution and the so-called threshold signatures, which are often used by exchanges and custodian services.

“MuSig2 provides the same level of functionality and security as MuSig1, but provides the ability to eliminate most interactions between participants. You only need two rounds of communication to create a signature, and one of the rounds can be prepared in advance, “the developers write.

In mid-October, it was reported that support for Taproot technology and Schnorr signatures had been incorporated into the Bitcoin Core code. However, the timing and methods of activating updates have not yet been determined.

Derivatives Exchanges Prepare to Start Trading ETH from Ethereum 2.0 Deposit Contract

06/11/2020

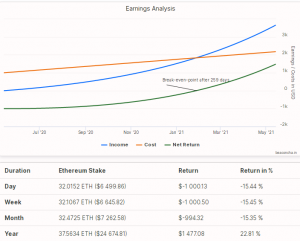

The FTX cryptocurrency derivatives exchange has expressed its readiness to place tokenized ETH based on the Beacon Chain (BETH) signal chain blocked in the Ethereum 2.0 deposit contract.

On November 4, the developers of Ethereum 2.0 presented a tool for creating an ETH 2.0 deposit contract, which will allow sending Ether from Ethereum 1.0 to Ethereum 2.0. According to Etherscan, to date, the contract already contains more than 19,600 ETH worth $ 7.9 million. The launch of the derivatives market for BETH will provide access to liquidity for investors who cannot use the coins from the deposit contract until the first phase of the renewal.

However, Ethereum Foundation researcher Justin Drake said that the deposit contract was specifically designed to prevent another type of ETH from becoming available for trading. And Ethereum co-founder Vitalik Buterin doubts that anyone would want to provide liquidity for the second version of Ether, sent to staking, since moving ETH to Ethereum 2.0 without a validator status will not bring profit.

At the same time, Coin Metrics co-founder Jacob Franek (Jacob Franek) believes that this will not stop exchanges from listing such assets, performing the function of “debt” coins. Their price may depend not only on the reward for staking ethers in the Beacon Сhain. The cost can also be influenced by the risks associated with trading products based on the blockchain, which is still in development. For example, penalties for failing to validate a new chain can negatively impact deposits. In turn, this will be reflected in BETH trading.

Anonymous cryptocurrency researcher Hasu believes intermediaries should be concerned about security first. People who take on financial risks will no longer just issue blocks, and block validators will only bear indirect financial risks. Hasu proposed linking the BETHs available for trading to the amount of Ether allocated for staking on centralized exchanges.

As a reminder, the Ethereum 2.0 update is scheduled for December 1, 2020 subject to certain conditions.

UN Regional Adviser: “blockchain is an effective tool for fighting corruption”

05/11/2020

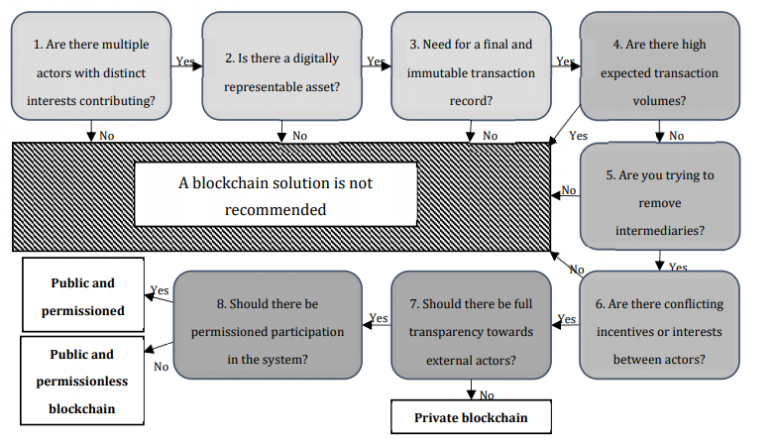

David Robinson, regional adviser to the UN Office on Drugs and Crime, believes that blockchain will help governments in different countries fight corruption.

David Robinson stated that blockchain-based solutions will help fight not only corruption, but also other economic crimes. The blockchain will provide full traceability of transactions, prevent changes to already entered data and protect documents from forgery.

According to Robinson, due to corruption, society ceases to trust the state, and blockchain can become an important tool for increasing trust in the government. In particular, he mentioned Kenya – due to the lack of effective ways to combat bribery and the inability to track incidents of corruption, the country loses about $ 6 billion of its budget annually.

Many countries are already considering blockchain to transparently track transactions and reduce the likelihood of receiving bribes. Thus, according to a report from the Danish Ministry of Foreign Affairs, blockchain and big data technology can be used to securely exchange information, keep records of births and deaths, and keep track of car registrations.

The Peruvian government and the Inter-American Development Bank (IDB) are also ready to use blockchain to create a transparent contract procurement system that will be protected from data manipulation, unauthorized access and fraud.

This summer, the World Economic Forum (WEF), together with the government of Colombia, began testing a project based on Ethereum to increase the transparency of government processes and prevent corruption. In addition, the WEF concluded that blockchain can save billions of dollars by increasing the efficiency of supply chains.

Gibraltar became a GBBC member for the development of blockchain in the country

05/11/2020

Gibraltar has become a member of the Global Blockchain Business Council (GBBC), an organization dedicated to blockchain development in more than 50 countries.

Gibraltar’s Minister of Digital and Financial Services, Albert Isola, has announced that the government will promote blockchain adoption in the British Overseas Territories. This requires organizing training seminars for business leaders and legislators, as well as consulting on the regulation of firms in the industry.

The initiative aims to make the country more “blockchain-friendly”. GBBC CEO Sandra Ro expressed her gratitude to the Government of Gibraltar for their willingness to work with GBBC to introduce the latest technology. Roh believes that blockchain can take economies of different countries to the next level, opening up many opportunities for enterprises to develop.

GBBC was launched in Davos in 2017. Its goal is to protect the interests of firms that develop solutions on the blockchain, partner with leaders from different countries, as well as provide detailed information to government and regulatory authorities about the principles of blockchain operation. In a study conducted by GBBC last year, 63% of institutional investors have little understanding of the technology and are not interested in using it.

As a reminder, Izola signed a memorandum of understanding last year on behalf of the University of Gibraltar, which has partnered with the research department of the Huobi cryptocurrency exchange to conduct academic research on DLT. In September, the Gibraltar Financial Services Commission (GFSC) updated guidelines for blockchain firms and added guidance on token issuance and risk management.

69370 BTC withdrawn from one of the largest bitcoin wallets, which have lain for more than seven years

04/11/2020

On the day of the presidential election in the United States, bitcoins were set in motion on one of the largest wallets. Five hours ago, someone sent 69,370 BTC that hasn’t moved since October 2013.

A few hours ago, the Whale Alert service reported a large transaction from the address 1HQ3Go3ggs8pFnXuHVHRytPCq5fGG8Hbhx, widely known among crypto enthusiasts and hackers. About two years ago, a wallet.dat file appeared on the darknet, presumably containing keys to this address, but no one was able to crack the password.

Today, first 1 BTC was withdrawn from this wallet, and a few minutes later – the entire remaining amount, which at the current exchange rate is close to $ 950 million. Also, the same amount of Bitcoin Cash was withdrawn from it, and soon they will probably be followed by coins from other forks that are worth something.

Such total devastation speaks precisely of hacking the wallet, and not of transferring to another storage at the initiative of the owner. After all, no matter how complex the password from wallet.dat, sooner or later it can be brute-force – it is much easier than picking up the private key from the address “from scratch”. Such a huge “bonus” justifies any cost of computing resources.

Until today, this address was the fourth in the list in terms of the amount of stored bitcoins. Now this place of honor has passed to the recipient address, and this is the address of the new bech32 format, or native SegWit. The owners of both addresses are unknown.

A large amount of bitcoins (69,471 BTC) was transferred to the original address on October 4, 2013 – three days before the arrest of Silk Road administrator Ross Ulbricht. Therefore, many consider this wallet owned by Silk Road. Since then, this address has been diligently dusty with microtransactions, but to date, the only outgoing transaction from it in the amount of 101 BTC occurred on April 23, 2015. This is an argument against the version of the wallet belonging to Ulbricht, since he was already in prison at that time.

Whale Alert suggests that this wallet is linked to the MtGOX exchange that burst in 2014. Other versions will inevitably arise, but the real owners of both the old and the new addresses may forever remain unknown.

ETH 2.0 Developers Release a Tool to Create a Deposit Contract

04/11/2020

The Ethereum 2.0 developers have published a tool on GitHub to generate the keys needed to make a staking deposit in Ethereum 2.0.

On the night of November 4, the Ethereum 2.0 developers published a tool for creating an ETH 2.0 deposit contract on GitHub. The launch of the deposit contract will allow sending ETH from Ethereum 1.0 to Ethereum 2.0. This has brought the launch of phase 0 of the new version of the network one step closer.

Chain Games founder Adam Barlamm wrote:

“To quietly release the ETH 2.0 deposit creation tool on election day … tricky, very tricky.”

The Escrow Contract Tool is a key step towards the rollout of Ethereum 2.0 Phase 0. The deposit contract was successfully verified at the beginning of the year. It will allow validators to join the Beacon Chain by sending ETH to the contract. The published code allows you to generate the keys required to make a deposit in Ethereum 2.0. Phase 0 deployment will begin after the launch of the deposit contract.

Recall that recently the developer of the Ethereum Foundation Danny Ryan said that the launch of the deposit contract will take place in the first half of November. The contract must first receive approval following an audit of the BLST cryptographic library by the auditing firm NCC Group.

Atlas VPN: the number of attacks on cryptocurrency services decreased by 3 times in 2020

03/11/2020

According to Atlas VPN, the number of hacks of cryptocurrency services in the first half of 2020 decreased three times compared to the same period last year.

Atlas VPN experts calculated that over the entire history of the crypto industry, hackers managed to steal more than $ 13.6 billion. Despite the fact that fewer hacker attacks were made on cryptocurrency wallets, they turned out to be the most profitable. Over the past eight years, wallet operators have faced 36 hacks, resulting in losses of $ 7.1 billion.On cryptocurrency exchanges, cybercriminals carried out a total of 87 successful attacks, during which they stole $ 4.8 billion.

The most successful in terms of number were attacks on decentralized applications on the EOS blockchain – they accounted for 36% of all hacker attacks in the blockchain industry. In aggregate, the losses of such applications as a result of hacks amounted to $ 28.2 million. The actions of cybercriminals and decentralized applications on Ethereum could not be avoided – 33 successful attacks were carried out on them, losses amounted to $ 364.3 million. Decentralized applications based on Tron also became a target for hackers. Cybercriminals carried out 21 successful attacks on such applications, earning $ 1.22 million.

In addition, attacks were carried out on various blockchains. Since 2012, blockchains have suffered from 28 hacks, during which criminals earned $ 45.8 million. The most attractive networks for hackers were Bitcoin Gold and Litecoin Cash.

According to Atlas VPN, 2019 was a record year for the number of hacks in the cryptocurrency industry. In the first half of last year, 94 hacker attacks were successful, and in total, 133 attacks were carried out in 2019. However, in the first half of 2020, this figure dropped significantly to 33 attacks. Experts have suggested that even if attackers continue to operate with the same efficiency until the end of the year, the number of hacks will still not reach the “record” of last year.

Recall that recently, criminals attacked the Harvest Finance decentralized finance protocol and were able to withdraw $ 25 million worth of crypto assets. This led to a record increase in daily trading volumes on the DeFi exchanges. In addition, in September, the Slovak cryptocurrency exchange Eterbase suffered from a hacker attack, the total damage of which is estimated at $ 5.3 million.

Hackers demand ransom in cryptocurrency from patients of Finnish medical centers Vastaamo

03/11/2020

In Finland, hackers have gained access to the medical records of patients in psychotherapy centers and are demanding a ransom in cryptocurrency, otherwise threatening to publish the information in the public domain.

The hackers gained access to the medical data of 40,000 patients at Vastaamo psychotherapy centers. The attackers exploited a security breach that appeared as a result of a hack in 2018, but which was not previously known. The hackers began contacting patients whose data had been compromised and sending them messages with the following content:

“Your data from psychotherapy sessions will be published if you do not pay me € 500 in cryptocurrency within 48 hours.”

The Vastaamo hack is one of the largest cryptocurrency ransom attacks on a medical facility. Attackers have already published over 300 case histories on the darknet and threatened to release more data if patients do not pay the ransom. A massive data breach led to the firing of Vastaamo CEO Ville Tapio.

The hackers are part of an organized group that regularly steals data for ransom. The delay between the 2018 security breach and the blackmail attempts that began on October 21, 2020 is attributed to the “heavy workload” of the hackers and the fact that it took the group a long time to decipher the Finnish documents and understand their value.

Cybersecurity companies have joined forces with blockchain analytics providers to track down and identify hackers. Recall that in the spring, the largest network of private hospitals in Europe was attacked by a ransomware virus. In addition, hackers attacked the information system of a hospital in the United States, demanding a ransom in cryptocurrency.

Harvest Finance has increased the reward for returning stolen cryptocurrencies to $ 1 million

02/11/2020

The management of the Harvest Finance project, which works in the field of decentralized finance (DeFi), has increased the fee from $ 100,000 to $ 1 million for assistance in the return of stolen cryptocurrencies.

Recall that on October 26, hackers attacked the Harvest Finance protocol and withdrew cryptocurrencies worth about $ 34 million, using an instant loan to manipulate the prices of fUSDT and fUSDC. The developers of Harvest Finance turned to the cryptocurrency community on Twitter for help in recovering assets.

The attack organizer understands the principles of instant loans, internal Curve code and renBTC; understands cryptocurrency and arbitrage trading and knows how to ensure the secrecy of transactions. In addition, the hacker is familiar with profitable farming, can write smart contracts and can use cryptocurrency mixers, including in the darknet. It is also known that the attacker was available during the attack.

The management of Harvest Finance is ready to pay one internal FARM token to five random people who will retweet the record. Initially, the refund fee was $ 100,000, now it has risen to $ 1 million, and it is not necessary to publicly reveal the identity of the hacker, it is enough to convince him to return the stolen cryptocurrencies.

Some users have commented that it will be much more effective if Harvest Finance developers work more closely with law enforcement on this issue. And $ 1 million can be spent on further development of the project or on payments to affected users. Recall that due to the hacking of Harvest Finance, the daily trading volume on the decentralized exchanges Uniswap and Curve Finance exceeded $ 2 billion.

Research: Most DeFi projects remain centralized

02/11/2020

According to a joint report by think tank DappRadar and Monday Capital, most DeFi projects have a high degree of centralization due to the token distribution model.

The authors of the report stated that in the MakerDAO, Curve, Compound and Uniswap projects, tokens are unevenly distributed, which creates favorable conditions for large holders. The Maker control system is the most “mature”.

At the MakerDAO forum, community members can conduct a preliminary analysis and discuss the proposals that are put to the vote. The forum is open even to those who are not holders of MKR. However, the voting process in Maker can be controlled by large token holders. These include 20 addresses, where 24% of the total MKR volume is concentrated. However, analysts have concluded that compared to other projects, the distribution of tokens in Maker is the most equitable.

As for Compound, the main holders of COMP tokens were venture investors, team members and some projects, in particular, Dharma and Gauntlet. Only 2.3% of addresses have the possibility of delegation. This means that only this small part of the community can participate in project management, and if you exclude exchange addresses, this figure may be even lower. Similar problems arise in the Uniswap and Curve projects. In the case of Curve, one address controls 75% of all votes.

Analysts have named three main factors that contribute to the centralized management of DeFi projects. First, many users do not view their tokens as a voting tool, but use them to participate in profitable farming. Network members receive voting tokens as a reward. At first glance, the idea seems good – management goes to those who use the product. But in this case, material motivation becomes stronger than the desire to manage.

Second, such systems operate on the principles of plutocracy, where wealth determines power. This is due to the lack of minimum requirements for voting participants to ensure the necessary level of decentralization, and no one is able to compete with large token holders. Identifying participants in decentralized protocols is quite difficult, and plutocracy becomes the only method of governance.

Third, initial investments also play an important role in centralizing management. Venture companies and other investors often own large amounts of tokens, and for this reason other users lose interest in voting. Analysts have concluded that it is the distribution mechanisms that encourage centralized management, so the current result should come as no surprise.

According to MolochDao researchers, the transition to Ethereum 2.0 could put DeFi applications at risk due to reduced liquidity, which could also lead to centralization.

Former PBOC CEO: “digital yuan will prevent dollarization of the economy”

30/10/2020

Former head of the People’s Bank of China (PBOC), Zhou Xiaochuan, said the digital yuan will develop retail payments in China and prevent dollarization of the economy.

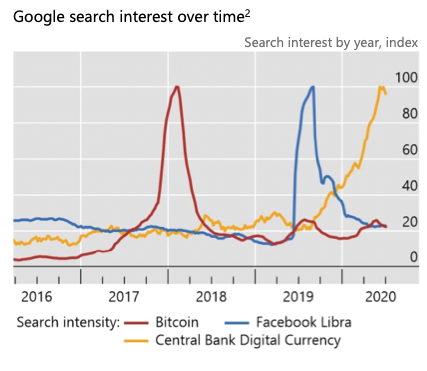

The President of the Chinese Finance Association said this at the Eurasian Forum. Zhou Xiaochuan said China’s central bank views government cryptocurrencies differently from the G7 countries, which include Canada, France, Germany, Italy, Japan, the United Kingdom and the United States. Regulators in these countries are focused on the challenges and threats posed by Bitcoin and other digital currencies, and even the unreleased Libra stablecoin.

China’s central bank focuses exclusively on using its digital currency for domestic retail payments. The agency is trying to prevent the popularization of the US dollar and is taking measures to reduce the use of the dollar for settlements in China. According to Xiaochuan, this is the main purpose of the digital yuan.

Last year, the US Treasury Department began to investigate the systemic risks of the Libra cryptocurrency project, which could affect the international economy. At the same time, the United States is in no hurry to launch its own digital currency. Recently, Federal Reserve Chairman Jerome Powell said that the digital dollar should not be launched until all risks associated with cyber attacks, fraud and money laundering have been eliminated.

Many central banks hold a similar position, believing that it is necessary to study the problems of government stablecoins more carefully. They can become a partial analogue of fiat money, which raises many questions related to legal and regulatory norms.

China’s approach to central bank digital currencies is indeed different from other countries. Instead of theoretical reasoning, the Chinese authorities prefer to conduct research in practice. Testing of the China Digital Currency-Based Electronic Payment System (DCEP) began in August, and this month, the NBK announced that a hardware wallet for the digital yuan is ready for testing.

Aave Developers Transfer Protocol Control to LEND Token Holders

30/10/2020

The developers of the DeFi Aave project announced the transfer of rights to manage the protocol to the LEND token holders. Aave has become the largest self-governing decentralized finance protocol.

The administrative keys to the protocol were originally in the hands of the Aave team. However, the project has now reached the stage where the management of the protocol can be transferred to the shoulders of the community and Aave can be truly decentralized. For this, administrative rights were transferred to the community of LEND token holders.

As part of the transfer of control of the protocol, the Aave Governance smart contract was empowered to change the protocol parameters and properties of the main Aave smart contracts, including the LendingPoolAddressProvider – the underlying smart contract of the protocol.

“Today is one of the most important milestones in the development of Aave: we have officially transferred the administrative keys of the protocol to the community. This is a very important step towards full decentralization, ”the developers wrote in the project’s blog.

Following the transfer of control of the Aave project to the community, LEND token holders have already voted for one change. This is the launch of the ability to migrate LEND tokens to AAVE tokens in a 100: 1 ratio. In the future, this will allow transferring control of the protocol to AAVE token holders.

As a reminder, the Aave protocol management system using tokens on the Ethereum mainnet was launched at the end of September. Almost $ 1 billion is currently blocked in the Aave protocol

TelosTask Decentralized Job Search Platform Beta Launched

29/10/2020

Telos startup has introduced TelosTask peer-to-peer platform on its blockchain. The platform was created to find work as freelancers during a pandemic.

TelosTask development team leader Destiny Marshall announced that the platform will operate on the Telos blockchain. Telos is a fork of the EOS project and runs on the EOSIO software.

According to the principles of work, the TelosTask service will not differ from ordinary exchanges for finding remote work. Customers will be able to form various tasks for writing articles, graphic design, video editing, etc. Customers will have the opportunity to directly communicate with performers and coordinate their work, while all information about their interaction will be stored in the blockchain.

Marshall hopes TelosTask will help people solve the unemployment problem and more easily overcome the economic downturn and isolation during the pandemic, as people need additional sources of income. An escrow system will be used to make secure automatic payments on the platform. In addition, the use of smart contracts will guarantee timely settlements and fair remuneration for the work performed.

Telos is not the only project using the power of blockchain to solve social problems. Last year, bitJob launched the Ethereum blockchain-based job search platform. The Freelance for Coins platform has also appeared, allowing freelancers to receive payments in various cryptocurrencies.

According to a study by Humans, conducted two years ago, 29% of 1,100 surveyed American citizens who work remotely are willing to accept payments in cryptocurrencies. However, given the rapid development of the cryptocurrency industry, this figure can be much higher today.

OKEx Denies Rumors Of Keeping Users’ Assets In A Cold One-Signed Wallet

29/10/2020

After the arrest of one of the founders of OKEx and the suspension of withdrawals, rumors emerged that the exchange was storing users’ assets in a cold, one-signature wallet. However, the company denies this.

The press service of the OKEx exchange told the industrial media that the information published on the Jinse Caijing website regarding the storage of cryptoassets of exchange users in a cold wallet with one signature is incorrect.

Recall that the founder of the exchange, Xu Mingxing, was detained by the Chinese police earlier this month, after which the withdrawal of crypto assets from the exchange was suspended due to the “unavailability” of one of the holders of the private keys.

A spokesman said he could not “disclose any information as it could jeopardize users’ assets.” He also did not say when the withdrawal will be resumed. The posting from the Jinse Caijing website has been removed.

When asked if OKEx uses a single-signature wallet, the press service referred to a 51% attack report on Ethereum Classic, which details the process of withdrawing crypto assets from the exchange, including the use of “semi-autonomous multisignature” for hot wallets.

According to the report, 95% of money is held in cold wallets. The cold wallet security detail page states that when generating private keys, the Advanced Encryption Standard (AES) password is “controlled by two exchange employees” – one at the OKEx office in Beijing and the other in a city on the west coast of the United States.

To withdraw cryptoassets, an employee visits “a bank safe near the office and retrieves the required number of unused encrypted private keys.” It then scans the QR code of the keys on two separate stand-alone computers. Thereafter, “the owner of the master AES password decrypts the private key on a completely autonomous computer.”

The final step is “signing the transaction on another completely autonomous computer. After that, the signature of the transaction is synchronized via a USB drive with a computer connected to the Internet and broadcast to the network. ”

Recall that last month, the Chinese police began to investigate the activities of an OTC cryptocurrency trader due to participation in a deal with $ 73,500 obtained by illegal means. It is assumed that the funds were initially deposited on the OKEx exchange.

Huobi Exchange Adds Direct Purchase of Cryptocurrencies Using Bank Cards

28/10/2020

Cryptocurrency exchange Huobi has added the ability to directly purchase major cryptocurrencies using Visa and Mastercard without intermediaries.

Ciara Sun, Vice President of International Business Development at Huobi Group, announced that the service is being provided by Huobi Technology, the Gibraltar-based regulated arm of Huobi Global. Previously, users of the site already had the opportunity to purchase cryptocurrencies using these credit and debit cards, but when making such transactions, Huobi customers were redirected to third-party services.

Visa cardholders residing in European countries and Australia will now be able to directly buy cryptocurrencies on the exchange. Users from the UK, Gibraltar, France, Poland, Czech Republic, Netherlands and Australia will have access to direct purchase of cryptoassets using Mastercard cards.

“Eliminating middlemen will make it easier for users to buy cryptocurrencies, and their interaction with our trading platform will become smoother,” said Ciara Sun.

Huobi recently integrated the Banxa payment service, which allows UK citizens to make deposits in fiat currencies through the fast payment system Faster Payments. It also allowed EU users to make fiat deposits to the exchange through the European Single Payment System (SEPA), and Australian traders through the POLi payment platform.

As a reminder, Huobi launched Huobi Brokerage digital asset trading platform in January, targeting institutional investors. A few months later, Huobi introduced the Huobi Chain open test blockchain for Decentralized Finance (DeFi) with support for KYC and AML requirements.

OpenZeppelin Introduces DeFi Automated Application Build Platform

28/10/2020

Audit firm OpenZeppelin has unveiled the Defender open source platform for the automated creation of Decentralized Finance (DeFi) applications.

OpenZeppelin CEO Demian Brener said the Defender framework allows for the secure automation of smart contracts. This significantly speeds up the creation of applications, which usually takes several months for developers. Defender supports level 1 and 2 smart contracts, as well as sidechains. The platform is already being tested by decentralized finance projects Aave, Compound Labs, dYdX and Balancer.

The Defender software is designed to ensure that developers don’t have to reinvent the wheel with each project. Building your own tools from scratch or writing code in a hurry carries enormous risks, especially if firms are looking to get their product to market as soon as possible.

Props CTO Peter Watts (Peter Watts), who participates in the test platform, said working with smart contracts takes effort. The Defender will “make life easier” for developers and help avoid human error, and manage smart contracts easier and safer.

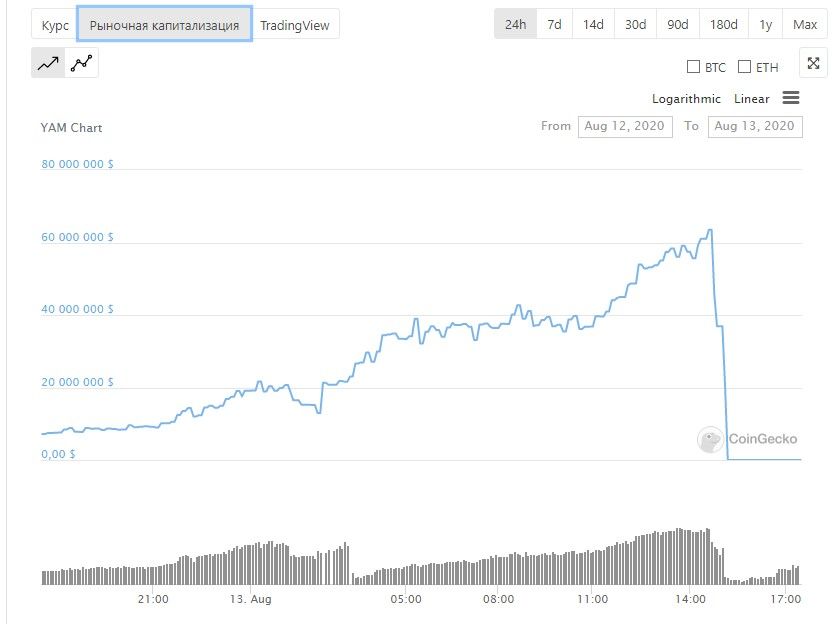

Many Ethereum-based DeFi applications are already facing serious issues from smart contract audits or vulnerabilities. A few days ago, hackers managed to carry out an attack on the Harvest Finance protocol and withdraw $ 25 million worth of crypto assets. In August, the YAM Finance project was closed due to a critical error in a smart contract that allows an unintended release of YAM tokens. In September, the YAM Finance developers announced a post-audit restart.

As a reminder, a year ago, OpenZeppelin launched a library of proven smart contracts in partnership with Microsoft.

Jack Ma: “Digital currencies are the future of the financial system”

27/10/2020

According to the founder of Alibaba, digital currencies will help create a new global financial system. Jack Ma also criticized global banking regulation.

Chinese billionaire Jack Ma said digital currencies could play an important role in the new global financial system. The founder of China’s largest tech company, Alibaba, expressed his stance at the Bund Summit in Shanghai.

“Digital currency can create value and we need to think about how to create a new type of financial system with digital currencies,” Ma said.

However, it’s not clear exactly what Ma meant when he talked about digital currencies. Binance CEO Changpeng Zhao tweeted that it was “an amazing speech” in which Ma “talked a lot about cryptocurrency and the future.” However, Ethereum co-founder Vitalik Buterin asked Zhao what exactly Ma meant by “digital currencies.” To this, Zhao replied that “the meaning can be interpreted in different ways.”

Ma may have been talking about government cryptocurrencies in his speech, such as the digital yuan, which is in the final stages of testing before its official launch. Recently, Governor of the People’s Bank of China (PBC) Yi Gang said that the development of a national digital currency will be one of the main drivers of the PRC’s transition to a digital economy.

Ma also said during his speech that global rules, in particular the Basel Accords – international guidelines for banking regulation – were already outdated. He added that global regulation is holding back China’s development and “does not take into account the possibilities of young people or developing countries.”

Recall that according to a study published in September KISSPatent, Alibaba almost surpassed the American computer giant IBM and by the end of this year will become the largest holder of patents related to the blockchain.

Central Bank of Switzerland and BIS will start testing the state cryptocurrency by the end of the year

27/10/2020

The Swiss National Bank (SNB) and the Bank for International Settlements (BIS) plan to start testing the state digital currency by the end of this year.

This was announced by Benoît Cœuré, Chairman of the BIS Innovation Center, at a conference in Shanghai. He said the Proof-of-Concept (PoC) will allow researchers to experiment with government digital currency, use it for retail payments, as well as study interactions with existing payment systems and monitor compliance with regulatory requirements.

BIS also plans to involve other central banks in the initiative, including the Hong Kong Monetary Authority (HKMA) and the Central Bank of Thailand. Köre believes that such cooperation will allow more efficient testing of cross-border payments using government cryptocurrencies.

Last year SNB and BIS teamed up to explore trends in the digitalization of the financial sector and expand their knowledge of financial markets. Departments believe that digital currencies from central banks can simplify the settlement of tokenized assets between financial institutions. However, such digital currencies should “peacefully coexist” with fiat currencies and not endanger the financial stability of states.

Recall that earlier BIS announced its intention to create four additional branches of the Innovation Center within two years to conduct research on digital currencies and financial technologies, as well as to study issues related to cybersecurity, artificial intelligence and digital payments. In addition, this month, BIS, along with several central banks, presented a report outlining the basic principles for issuing government cryptocurrencies.

US Federal Reserve and FinCEN proposed to tighten tracking of cryptocurrency transactions

26/10/2020

The Federal Reserve and the Financial Crimes Enforcement Network (FinCEN) have proposed lowering the threshold for registering remittances outside the United States, including for cryptocurrency transactions.

According to the document, the US Federal Reserve and FinCEN are proposing to change the thresholds at which banks must collect and store information about remittances. Regulators are proposing to decrease this value from $ 3,000 to $ 250 for any transfers outside the United States. The proposal will also expand the definition of “money” to include cryptocurrencies.

The Fed will accept public comments for 30 days after the proposal is posted on the Federal Register. Individuals can submit reviews online or via email. Note that although cryptocurrencies do not have legal tender status, according to the proposal, they can still be used to transfer value:

“Typically, cryptocurrencies can be exchanged instantly anywhere in the world through P2P payment systems that allow any two parties to transact directly with each other without the need for an intermediary financial institution. In practice, however, many people store and transfer cryptocurrencies using a financial intermediary such as a “wallet” or “exchange”.

The document points out illegal transactions using cryptocurrencies, including transfers by the North Korean hacker group Lazarus. Recall that in the spring, CipherTrace published a detailed analysis of how Lazarus hackers laundered stolen crypto assets worth more than $ 100 million, bypassing KYC checks on cryptocurrency exchanges.

BNY Mellon has processed $ 137 million in transactions for organizations linked to the OneCoin pyramid, according to FinCEN documents released last month.

US IRS Updated Recommendations for Reporting Cryptocurrency Transactions

26/10/2020

The Internal Revenue Service (IRS) has made changes to the taxpayer reporting form. Coins received during hard forks are taxed, and transfers between wallets do not need to be disclosed.

In the latest version of the Personal Income Tax Form 1040, the IRS has clarified which cryptoassets and transactions need to be disclosed. According to the new principles, if a user only owned a cryptocurrency, but did not trade it during 2020, then he can answer “No” to the question of trading, selling or receiving crypto assets in another way.

The updated guidelines provide specific examples of cases that fall under receiving, selling, sending, and exchanging cryptocurrencies. Crypto assets received for free during hard forks are considered taxable assets. As well as the exchange of cryptocurrencies for goods, services or “other property, including another virtual currency.”

“Transferring crypto assets between wallets, such as transferring money to an exchange and back, is considered a transfer for administrative purposes,” said Shehan Chandrasekara, head of tax strategy at CoinTracker.

Thus, users may not report transfers between personal wallets, as this does not represent a sale, exchange or purchase of cryptoassets. At the same time, Chandrasekhar noted that the approach of the IRS as a whole has not changed, but rather clarified it:

“The IRS just once again clarified the taxation of crypto assets. This shows that for the IRS, transactions that are reflected in tax reporting matter. At the moment, the IRS does not seem to be interested in the amount of cryptoassets users hold. You are not required to disclose information about them anywhere if no taxable transactions took place. ”

As a reminder, last fall, the IRS added a clause about cryptocurrencies to Form 1040. In February this year, the IRS updated the definition of virtual currency on its website. In the new version, game tokens were excluded – since then they are not subject to declaration in tax reporting.

Report: MESS system will not provide sufficient protection for Ethereum Classic against “51%” attacks

According to the latest report, the MESS system launched by ETC Labs to protect Ethereum Classic against “51%” attacks may not be as effective or secure as other alternative solutions.

This summer, the ETC blockchain fell victim to three 51% attacks in a month. In mid-October, ETC Labs implemented MESS (Modified Exponential Estimation of Subjectivity) to reduce the likelihood of future attacks by 51%.

However, according to a report by IOHK and ETC Cooperative, “The MESS solution will not provide the required level of security and there is no guarantee that further attacks will not be successful.” In addition, MESS does not provide “high confidence to stakeholders that confirmation time will be reduced to the desired level”.

MESS is designed to make reorganizing a large number of blocks 31 times more expensive, theoretically negating a 51% attack profitability. As ETC Labs previously stated, if MESS, activated on October 10 after successful testing, had been implemented back in the summer, 51% attacks on the Ethereum Classic blockchain would have cost the attackers $ 20 million.

IOHK and ETC Cooperative have studied various solutions proposed by development teams from across the ETC community and have stated that checkpoint and time stamp solutions will provide better security than MESS.

According to the report, the timestamps would allow ETC to base its security on another secure blockchain like Bitcoin. The checkpoint system implies that the “trusted authority” chooses a block that will represent an unchangeable standard for all participants in the network.

ETC Cooperative CEO Bob Summerwill said he hopes the report will be the first step towards decentralized decision making by ETC developers. The report also proposes to implement a “decentralized treasury” that provides a constant source of funding for the future development of the ETC platform.

“A democratic and transparent funding mechanism will also allow the ETC community to determine its future direction of development and choose which innovations will be included in the ETC” ,.

The report claims that this will ultimately allow ETC to “keep up with and even surpass other platforms.”

NAC Foundation Denies SEC Fraud Allegations

23/10/2020

The NAC Foundation denies that AML BitCoin is a security and accuses the US Securities and Exchange Commission (SEC) of fraudulent conduct in a legal proceeding.

Earlier, the SEC accused the NAC Foundation, its CEO Marcus Andrade and political lobbyist Jack Abramoff of organizing an unregistered sale of AML BitCoin cryptoassets in the amount of $ 5.6 million, fraud and misleading investors. Abramoff agreed to pay a $ 50,000 fine, as well as $ 5,501 pre-judgment interest.

However, Andrade disagrees with the Commission’s allegations, and on October 20 asked a federal judge in San Francisco to dismiss the SEC’s claim. Andrade argues that the regulator is deliberately trying to mislead the court by accusing the NAC Foundation of using and offering technology that has allegedly never been developed. According to the defendant, the SEC was aware that the NAC Foundation has a patent for an anti-money laundering technology created specifically for AML BitCoin.

Andrade added that, in accordance with the terms of sale, AML BitCoin are not investment contracts. When purchasing this crypto-asset, users agreed that AML BitCoin is only a medium of exchange, not an investment or entitling to a share in any enterprise. The terms of sale state that NAC Foundation clients should not expect a return on their investment, and AML BitCoin cryptoassets should not be considered debt.

Andrade stressed that the SEC refused to point out a critical element of the Howie test, which helps determine whether an asset is classified as a security. This suggests that the sale of AML BitCoin did not violate securities laws. Consequently, there are no grounds for prosecution. Recall that, as the agency said last month, stock token exchanges that guarantee the legality of the origin of assets in their accounts will not be subject to regulatory sanctions.

Bitcoin exchange rate exceeded $ 12 800 and updated the maximum in 15 months

22/10/2020

Bitcoin has surpassed $ 12,800, hitting a high since July 2019 amid growing support from institutional investors and large companies.

Today’s leap in the rate was mainly due to the announcement of the PayPal payment system to add support for bitcoin and other cryptocurrencies. Quantum Economics analyst Jason Deane believes that reaching this mark is important for Bitcoin, after which it can renew highs and continue to grow.

Institutional investors are helping the development of Bitcoin’s bullish trend. Asset management firm Stone Ridge Holdings Group bought 10,000 BTC last week. Big Bitcoin investors also include Square, MicroStrategy and Stone Ridge. In addition, earlier this month, Twitter founder Jack Dorsey revealed that his payment company Square acquired 4,709 BTC worth $ 50 million. After the news broke, the BTC rate rose to $ 10,935. Interlapse Technologies CEO Wayne Chen commented on the situation, saying that corporate support creates a favorable background for Bitcoin’s growth.

The current technical picture on the bitcoin chart suggests continued growth despite the fact that many futures traders are betting on an early reversal and the beginning of a new bear market.

PayPal Adds Cryptocurrency Support For US Users

22/10/2020

US PayPal users will be able to buy, sell and store cryptocurrencies. It is planned to add these features for international customers in 2021.

US citizens will be able to conduct cryptocurrency transactions via PayPal in the next few weeks, and the company’s Venmo mobile payment service will add this capability in the first half of 2021. On this news, bitcoin rushed up and is preparing to overcome $ 12,500, updating the maximum since last summer.

In addition, from the beginning of next year, it is planned to open these functions to other countries so that all PayPal customers can use cryptoassets to buy goods in 26 million stores around the world. When making cryptocurrency payments through PayPal, they will be converted to fiat currency (for example, the US dollar). This means that everything will remain the same for sellers – they will receive payment for goods in ordinary money.

PayPal has been licensed by the New York State Department of Financial Services (NYDFS) to provide payment services using cryptocurrencies. This license is issued to companies partnering with licensed firms, which is why PayPal has partnered with Paxos Trust Company.

PayPal CEO Dan Schulman hopes that with the addition of cryptocurrency support, PayPal will help the industry grow at scale. In addition, this step will prepare the system to work with new digital currencies, which in the near future may be issued by corporations and central banks of different countries.

“We work with central banks, so we are considering interaction with all forms of digital currencies. PayPal will contribute to the development of the cryptocurrency industry, ”said Daniel Schulman.

Last year, PayPal CFO John Rainey said the company is taking a cautious stance towards cryptocurrencies due to their high volatility and a “dim” future. However, with central bank analysts actively exploring the possibilities of launching their own digital currency, PayPal management has changed its mind to follow the current trends.

A year ago, PayPal refused to participate in the Libra project. Shulman explained that it is better for the payment system to focus on its own development. If Libra’s prospects become more specific, PayPal will again be able to become a participant in the project, since it is supportive of the blockchain.

US Federal Reserve Chairman: “The digital dollar is not a top priority”

21/10/2020

US Federal Reserve Chairman Jerome Powell said the regulator will not issue a digital dollar until all associated risks have been eliminated.

Powell announced this during a speech at the International Monetary Fund conference on cross-border payments. According to him, the United States is not seeking to be the first to issue its own digital currency. Issuing a government stablecoin is a serious task requiring extensive research. It is necessary to take into account not only the positive aspects of the digital dollar, but also its potential risks, given that the US dollar is the world’s reserve currency.

“We have not yet made a final decision on the digital dollar release. I do not think that in the current situation this task should be in the first place for the country. There is no need to rush to create a state cryptocurrency. It is better to do it properly and efficiently, rather than hastily, just to be the first, ”said Powell.

He emphasized that, unlike many countries, there is a strong demand for cash in the United States. In addition, the country has a highly developed financial and banking sector – most of the population has access to banking services, and many use electronic payment systems.

The US central bank will not issue its own digital currency until all associated risks have been removed. This requires providing a high level of protection against cyber attacks and fraud, as well as eliminating the threat to financial stability and the country’s monetary policy. Moreover, you need to think about how to prevent illegal activities with the digital dollar, while maintaining the confidentiality of user data and ensuring the security of funds.

Recall that, according to Powell, private firms should not participate in the development of state-owned cryptocurrencies – only central banks should do this. However, the American Bankers Association (ABA) did not support the issuance of the digital dollar, saying that otherwise the US Federal Reserve would become a “monopoly” supplier of currency, bank accounts and payment services.

The user lost 28,050 AAVE after sending them to the smart contract address

21/10/2020

The user mistakenly sent AAVE tokens worth $ 1.1 million to the token’s smart contract address. Now these tokens are locked on the blockchain and cannot be returned.

Cryptocurrency enthusiasts discovered an erroneous transaction for 28,050 AAVE decentralized finance (DeFi) tokens worth approximately $ 1.1 million, which led to their irrecoverable loss due to an error in the recipient’s address.

According to Etherscan, the transaction took place back on October 3, but went unnoticed until this week. The transaction was discovered by the TokenOops service, which tracks “ERC20 tokens sent to the address of the ERC20 token smart contract”, after which they cannot be returned.

For some reason, the sender of 28,050 AAVE did not pay attention to the fact that he was transferring tokens not to his wallet, but to the address of the smart contract of the AAVE token. As a result, cryptoassets worth more than $ 1 million remained locked on the blockchain.

“The key point here was that the AAVEs were transferred to the address of the contract itself, and not to another account,” explained Chase Wright, an enterprise solutions architect at the Federal Reserve Bank of Chicago. “It’s like sending a letter to the post office address instead of another person’s.”

According to TokenOops, such erroneous transactions occur frequently, but usually the amounts sent are much smaller. However, not all such transactions are made by mistake. Some users deliberately send a small amount of cryptoassets to inactive or inaccessible addresses, for example, the address of the Bitcoin genesis block, as a tribute to the technology or to indicate their position on some issue.

The user who sent the erroneous transaction has a small chance of being compensated. Several members of the AAVE community have offered to return the tokens to the affected user.

The problem of cryptoassets sent to the wrong addresses is relevant for the entire community. In June, Israeli startup Kirobo developed a technology to return bitcoins sent to the wrong addresses by mistake, but this requires a special transaction format. Additionally, in May of this year, the Ethereum community discussed the possibility of creating a Decentralized Autonomous Organization (DAO) to return ETH sent to the wrong addresses.

Monero devs update Oxygen Orion

20/10/2020

The developers of the privacy-focused cryptocurrency Monero have rolled out another update to the Oxygen Orion network.

According to a Monero blog post, the latest node software update is the work of about 30 developers. The Oxygen Orion update will bring new features to improve network efficiency.

For example, the update includes the CLSAG feature, which reduces the size of network transactions by about 25% and the time to confirm transactions by about 10%. At the same time, the confidentiality of transactions is preserved. Monero developers noted:

“CLSAG provides a reduction in size and increased transaction speed with a high level of security.”

Oxygen Orion offers several more new features. These include improvements to network security, in particular with respect to the Dandelion ++ protocol, which is responsible for hiding the user’s IP address. Each Monero update can technically be viewed as a hard fork that requires network members to update their software in a timely manner.

In the blog, the developers write that users who store XMR in hardware wallets should also be updated to the latest firmware in a timely manner. The Oxygen Orion update was rolled out a few months after the Monero developers launched a new version of the 0.16.0.0 Nitrogen Nebula Monero client.

The network updates are taking place against the backdrop of increasing attention of regulators to anonymous cryptocurrencies. As a reminder, Europol recently named anonymous cryptocurrencies and wallets with privacy functions as the “top threats” in a new report on the assessment of threats to organized crime on the Internet for 2020. In addition, in early October, the IRS selected contractors to create Monero tracking tools.

Associated Press will use blockchain to combat false news

20/10/2020

The Associated Press (AP) news agency has partnered with Everipedia and Chainlink, a decentralized oracle network, to track down fake news.

The collaboration will allow AP to authenticate race-related news using blockchain, according to a statement from Everipedia. The Associated Press works with a large number of freelance journalists to get information on local campaign developments. The news agency will use the power of the blockchain to cryptographically sign the data it receives from these journalists.

This does not completely guarantee the accuracy of the news received, as it is possible that the main AP systems are hacked or the keys used to sign the keys are stolen. But otherwise, such a system is much more reliable than the usual transfer of information via e-mail.

Everipedia’s Chainlink node will provide smart contracts with cryptographically proven access to US election data. It can be used to verify that the data from the host is coming directly from the original Associated Press API, to which Everipedia has exclusive authenticated access.

This integration is made possible by leveraging the Chainlink oracle infrastructure, which allows the Associated Press to sign and publish US election results simultaneously on several different blockchains.

This is not the first attempt to use blockchain to combat fake news. In the summer, The New York Times, as part of a joint project with IBM News Provenance, began testing blockchain to combat fake news.

Previously, other media outlets have also referred to the blockchain. Back in 2018, the American magazine Forbes announced a partnership with a startup Civil to publish its content on a decentralized network. Recently, however, startup Civil, which has been working to create a decentralized platform for media funding and posting, announced it would close in June after four years in operation.

Power Finance will launch a digital version of the New Zealand Power Dollar

19/10/2020

Financial company Power Finance plans to launch a digital version of the Power Dollar, which will be powered by distributed ledger technology (DLT).

Power Finance is led by Dave Corbett, partner at audit and consulting firm PwC. He said the Power Dollar will be developed without the participation of the New Zealand government and will be similar to the USDT stablecoin. The Power Dollar will be pegged to the NZ dollar at a 1: 1 ratio. The launch of the digital currency is scheduled for early next year.

Along with DLT, Power Finance will use smart identification technology to verify the identity of all Power Dollar holders and record transactions to prevent money laundering and fraud. Corbett added that the Power Dollar will be compliant with New Zealand law and regulatory requirements.

The Reserve Bank of New Zealand (RBNZ) supports the firm’s initiative. However, RBNZ and the New Zealand Internal Revenue Service (IRD) clarified that they are not cooperating with Power Finance in creating a digital currency, so it cannot be said that it is being developed with government support. In addition, the departments said they are not responsible for regulating the activities of financial companies.

Following the launch of Power Dollar, the firm plans to obtain a banking license from RBNZ. Once approved by the regulator, Power Finance will begin attracting partners that will provide “banking-style services” outside of the traditional banking system. Corbett believes that in the event of a successful experiment with the Power Dollar in New Zealand, the country’s Central Bank will decide to issue its own cryptocurrency.

Recall that last year, the IRD recognized income in cryptocurrencies as legal, and at the beginning of this year proposed not to apply a tax on goods and services in relation to digital assets, but at the same time leave income tax. In addition, IRD recently sent letters to New Zealand cryptocurrency firms asking them to provide customers’ personal data and information about their cryptoassets.

Gate.io Cryptocurrency Exchange Launches Its Own Hardware Wallet

19/10/2020

Cryptocurrency exchange Gate.io has released the Wallet S1 hardware wallet. This is the first such device developed by a marketplace.

Wallet S1 is equipped with a fingerprint sensor – the user does not need to come up with and enter complex passwords, just put his finger to verify the transaction. Also, thanks to the fingerprint scanner, the hardware wallet is protected from a brute-force attack.

The device supports over 10,000 different digital assets including BTC, ETH, EOS and other popular cryptocurrencies. Gate.io Marketing Director Marie Tatibouet stressed:

“Wallet S1 is a very secure wallet. The secret key is stored on the device itself, without Internet access. In addition, it allows you to quickly and easily sign transactions. This is the first hardware wallet with a fingerprint recognition algorithm. ”

In addition to a convenient way of storing cryptocurrencies, Wallet S1 will provide users with a fast, easy and secure option to access Gate.io’s own blockchain called GateChain.

“Wallet S1 is also suitable for corporate use – it can be used in conjunction with a Vault address to gain access to GateChain. It is an open blockchain designed with security in mind. The device provides increased security for storing large amounts of assets for a business or financial institution, ”the exchange said in a statement.

Schnorr and Taproot signatures added to Bitcoin Core code

16/10/2020

Updates to improve the privacy and scalability of the Bitcoin network – Taproot and Schnorr signatures – are embedded in the Bitcoin Core code. The mechanism for activating updates has not yet been determined.

The privacy and scaling updates of Taproot and Schnorr signatures have been rolled out to Bitcoin Core today, according to version history on GitHub. Once the updates are activated, more complex types of transactions will become easier to use and the privacy of the network will increase.

The update code enablement request was created in September by developer Pieter Wuille and has been tested for over a month. More than 150 developers have reviewed the Taproot proposal code alone. Schnorr Signatures and Taproot, Bitcoin Improvement Proposals (BIPs) 340 and 341 are the two biggest changes to the Bitcoin code since Segregated Witness (SegWit) was activated in 2017.

The mechanism for activating the two BIPs has not yet been determined. Depending on the method chosen, it may take some time before the code is activated. Schnorr signatures are an alternative to the current multisignature mechanism that uses multiple private keys to complete a transaction. Schnorr signatures combine multiple keys into one when making a transaction. This significantly reduces the size of the payment data and helps to relieve the network.

Taproot complements Schnorr signatures and offers a new version of transaction outputs and new options for defining the conditions for spending BTC to users. In some cases, Taproot can even help restore access to lost coins. Schnorr Signatures and Taproot are useful for users with complex spending policies who usually control large amounts, such as cryptocurrency exchanges.

Algorand will provide grants to startups and app developers

16/10/2020

The Algorand Foundation has launched the Algorand Europe Accelerator program, under which it will provide grants to startups and application developers on the Algorand blockchain.

As the name suggests, the program is intended for European companies. The foundation is already accepting applications for a grant, and in general the program will last 12 weeks. Grant funding was provided by Eterna Capital and Borderless Capital. Companies entering the program will receive $ 15,000 each, and the maximum grant is capped at $ 500,000. In addition, additional funding from sponsors is possible.

“Europe is a critical region for Algorand’s growth, and London is a major innovation hub,” said Massimo Morini, chief economist at the Algorand Foundation.

In addition to grants through the accelerator, developers will have access to a “toolbox and resource kit” for building decentralized applications. Also, if necessary, entrepreneurs will be able to get advice on launching the application on the market, additional investments, issuing tokens and other aspects of developing their projects.

In August, Algorand developers added the ability to deploy stateful smart contracts. The function is useful for developers of decentralized applications.

Jeff Garzik’s Company Launches Vesper Platform to Invest in DeFi

16/10/2020

Bloq, led by Jeff Garzik, is releasing a new product for investing in decentralized finance (DeFi) projects through cryptoasset staking.

Bloq’s new platform, Vesper, is marketed as an easy-to-use tool for DeFi products. Through Vesper, users will be able to block ETH, wBTC or USDC for staking from mid-November using one of the “storage pools”.

Bloq co-founder, former Bitcoin Core developer Jeff Garzik, said that after depositing cryptoassets, users can choose the level of staking risk for profit – aggressive or conservative. Among the conservative-risk DeFi protocols, Garzik says, are the well-known Aave and Compound applications. With an aggressive approach, the platform will invest cryptoassets in lesser-known projects.

“We’re all tired of farming and dumping,” Jeff Garzik said at the CoinDesk invest: Ethereum economy conference. “There must be a market to transform these risky and often sloppy investments into more professional operations.”

Vesper will only be offering pools with a conservative staking strategy from mid-November. However, Bloq said it plans to add other investment strategies and crypto assets to the platform in the future. Vesper is backed by its own VSPR token, which will be used to distribute rewards to users and developers.

While the initial investment strategies will be developed by the platform team, Vesper will also offer strategies from developers who can be rewarded in VSPR if their proposal is accepted by the community. The platform will charge users 5% of the profits generated from staking their cryptoassets and 1% for withdrawing money from “storage pools”.

“This is a simple passive income product,” Garzik said. Vesper’s approach is somewhat similar to the strategy followed by ETFs, where the due diligence of an investment product is mainly performed by the issuer, he said.

More and more companies are looking to enter the DeFi industry amid its growing popularity. This week, corporate fintech platform COTI developed a decentralized cryptocurrency market volatility index (cVIX) to help investors assess industry risks.

Ethereum Foundation Developer Introduces Fe Programming Language To Create Smart Contracts

15/10/2020

Ethereum Foundation developer Christoph Burgdorf has introduced a new programming language called “Fe” for creating smart contracts.

Most Ethereum applications today are written in the Solidity language. Providing developers with a wider choice of languages will help develop the Ethereum ecosystem more efficiently.

Fe is a reworked version of the Vyper language that is used to work with the Ethereum Virtual Machine (EVM). Therefore, at the initial stage, the differences between Fe and Vyper will be minimal. In the future, Fe will borrow the syntax of the Rust programming language. The developers explained that the name “Fe” is directly related to the designation of iron in the periodic table. They associate this chemical element with the strength and stable operation of the compiler.

Fe was built to perform the same tasks that Vyper already solves, including more accurate calculation of transaction fees. Over the past month, the developers have accelerated the creation of Fe, so it is likely that by the end of this year it will have all the functions necessary to work with contracts of ERC-20 tokens.

At this stage, it is too early to use the Fe language to create such contracts, but the developers will be ready to demonstrate its capabilities in practice. In the future, Fe will be able to support Ethereum WebAssembly (eWASM) and Optimistic Virtual Machine (OVM), a virtual machine for scaling smart contracts on Ethereum.

Recall that in June, the Algorand and Blockstack projects began joint development of the Clarity language – a new programming language for smart contracts that can provide direct interaction between these networks using different mechanisms: the Proof-of-Stake (PoS) algorithm and the “Proof of transfer” (Proof-of-Transfer, PoX). In addition, a few months ago, Bitcoin Core developer Jeremy Rubin announced the creation of a new smart contract language for Bitcoin that will increase users’ control over their bitcoins.

Jeff Horowitz steps down from Coinbase

15/10/2020

Coinbase officials said Jeff Horowitz, head of corporate governance at Coinbase, is leaving his post. The reasons for his departure are unknown.

Horowitz began his career at Lehman Brothers and Citigroup and took up a senior position at Coinbase in 2018. According to the exchange staff, he made a huge contribution to the establishment and improvement of procedures aimed at combating money laundering and customer identification. Horowitz has also helped Coinbase comply with the Financial Action Task Force (FATF), the Financial Crimes Enforcement Network (FinCEN), the US Treasury Department, and other regulators.

In addition, Horowitz has worked hard to get the American investment bank JPMorgan to partner with Coinbase. Marketplace officials believe that by joining Coinbase as Chief Compliance Officer, Horowitz has taken every possible step to legalize the cryptocurrency industry, which is still in its early stages of development.

The exact reasons for the dismissal were not disclosed, but Horowitz’s colleagues clarified that his departure from Coinbase is not related to the recent announcement of the CEO of the exchange Brian Armstrong (Brian Armstrong). According to Coinbase’s new mission, the exchange refuses to discuss political and social topics unless they are related to the cryptocurrency industry. Armstrong urged his team to focus on solving the main tasks of the platform. Those who disagreed with Coinbase’s new philosophy could leave their jobs and receive compensation. About 5% of Coinbase employees decided to take advantage of this opportunity.

Horowitz previously revealed that Coinbase has begun working with the Gemini, Kraken and Bittrex exchanges to launch a unified user data exchange system in order to comply with FATF requirements.

PwC report: blockchain will drive the global economy by $ 1.76 trillion by 2030

14/10/2020

Blockchain will boost the global economy by $ 1.76 trillion over the next decade, with the greatest economic impact going to be seen in Asia, according to a new report from consultancy PwC.

PwC economists predict that a tipping point will come in 2025 if blockchain is widely deployed around the world. In addition, blockchain applications are expected to drive global gross domestic product (GDP) growth of $ 1.76 trillion (1.4%) by 2030.

Blockchain will have the biggest impact on the Asian economy as China, India and Japan drive technology adoption across the region, according to the report. China could get the highest net profit of $ 440 billion, and the US $ 407 billion. According to analysts, the economies of Germany, Japan, the UK, India and France can expect to grow to $ 50 billion over the same period.

The report identifies five key blockchain applications with economic value potential: product supply chain tracking ($ 962 billion), financial services and payments ($ 433 billion), identity and credential security ($ 224 billion), contracts and dispute resolution ($ 73 billion). , customer acquisition and reward programs ($ 54 billion).

The government, education and healthcare sectors will benefit the most ($ 574 billion) by “capitalizing on the efficiency that blockchain brings to the world of identity and credentials.” A PwC survey found that 61% of CEOs worldwide make digital transformation of their core business operations one of their top three priorities.

“Serious blockchain activities are now affecting industries around the world,” PwC Blockchain Leader Steve Davies said in a report. He also added that the acceleration of the introduction of revolutionary technologies in business is caused by the coronavirus pandemic.

Recall that in the summer, PwC, RFID solutions provider Temera, blockchain company Luxochain and Italian IT firm Var Group created a blockchain-based platform for authenticating luxury goods.

Ethereum 2.0 Developers Successfully Launch Zinken Testnet

14/10/2020

Ethereum 2.0 developers have successfully launched the Zinken testnet and tested the creation of the ETH 2.0 genesis block. Zinken launched after a failed deployment of the Spadina testnet.