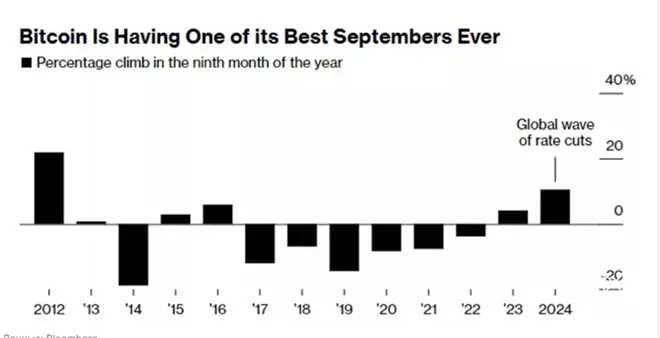

Bloomberg experts said that Bitcoin’s rate has grown by more than 10% in September. The value of the first cryptocurrency has risen by 56% this year, which was facilitated by the influx of funds into spot Bitcoin ETFs, analysts noted.

According to market experts surveyed by Bloomberg, Bitcoin’s price dynamics in September are in sharp contrast to the coin’s typical behavior for this month – a fall of 5.9% on average

Sean McNulty, director of trading at liquidity platform Arbelos Markets, said that Bitcoin’s correlation with the US Federal Reserve’s monetary policy continues to be at its highest, and lower interest rates are providing further support to the cryptocurrency.

However, the Bitcoin rate, which has frozen at just above $65,000, may prove volatile due to the expiration of a large number of options contracts, noted Caroline Mayron, co-founder of Orbit Markets, a company that provides liquidity for digital asset derivatives trading.

The crypto market is currently awaiting the end of the US presidential election race, and many market participants expect investor sentiment to rise after the new White House administration formulates clear rules for regulating cryptocurrencies, Bloomberg experts said.

Earlier, analysts at the international financial corporation Standard Chartered pointed out a number of factors that could support the growth of Bitcoin next month. According to them, investor expectations have improved after the Fed’s rate cut.