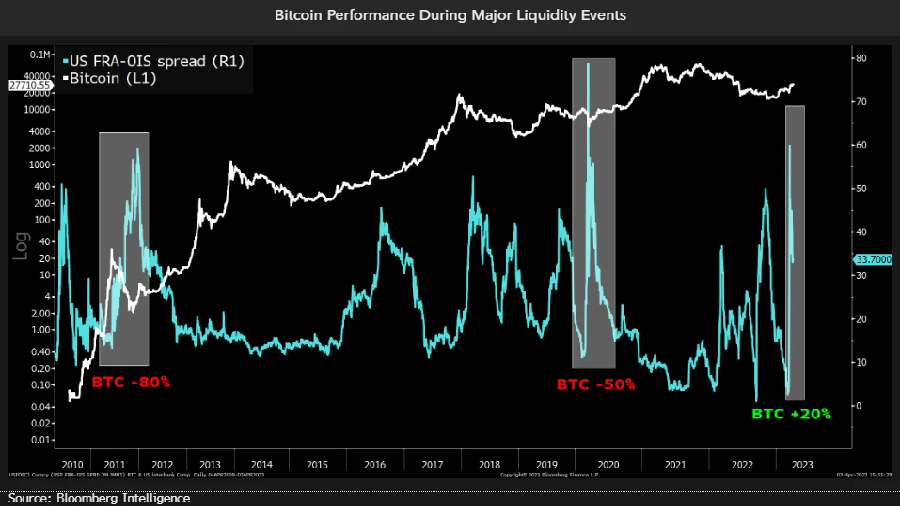

Bloomberg Intelligence analysts cited data on the growth of investor confidence in bitcoin: the first cryptocurrency successfully passed a liquidity stress test amid the US banking crisis.

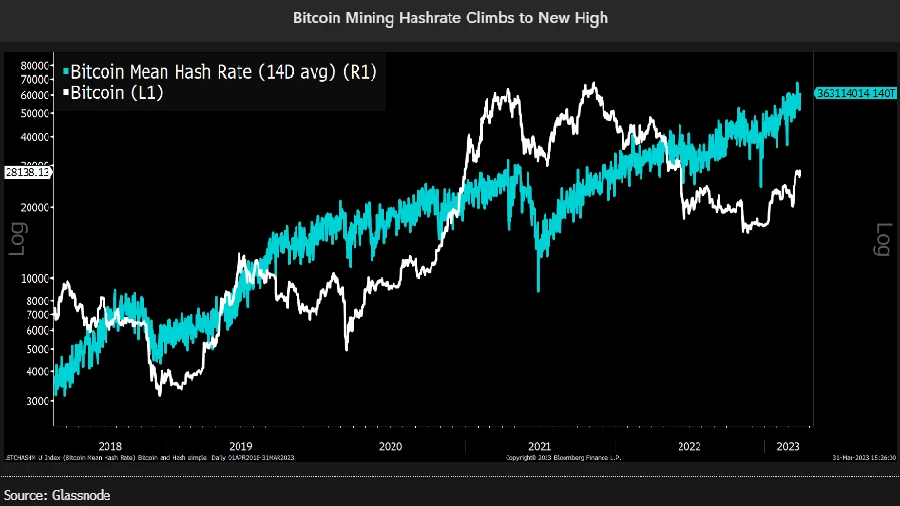

A study by Bloomberg Intelligence experts says that for the vast majority of crypto investors, bitcoin continues to be the underlying asset that hedges the main risks. The rate of growth in the market value of this asset in the first quarter of 2023 and the hashrate-based trust in the network confirm analysts’ conclusions about the potential dominance of BTC as a global reserve asset.

The excess of investment attractiveness of bitcoin was observed throughout the first quarter of 2023, despite the growing turbulence of the cryptocurrency market caused by a record increase in Fed rates, a liquidity crisis in the US banking system and the subsequent exodus of depositors.

Against the background of how the interbank loan rate rose above 60 basis points, the BTC showed an increase of more than 20%. Thus, bitcoin has passed an important test as a means of protecting against the consequences of the instability of the banking system, analysts say.

“As central banks and regulators try to build confidence in fractional reserve banking, Bitcoin’s armor of decentralized and distributed nodes, miners, and users is organically getting thicker. The hashrate doubling during the 2022 bear trend, combined with an exceptional start to 2023, is truly impressive,” Bloomberg Intelligence said in a report.

Bloomberg Intelligence believes that the Bitcoin blockchain network has never been more secure than it currently is. The significant increase in network hashrate , up 25% at once since the beginning of the year, indicates the fact that the total trust in the network is at an all-time high. Bloomberg experts explain: the hash rate refers to the computing power of the network, which is used to process and verify transactions on the Bitcoin blockchain. The higher the hashrate, the more difficult it is for any individual entity to control the network or manipulate the history of transactions.