NEWS Feed

Analysts at the London Crypto Club, a crypto community of traders and investors from the UK, have stated that the Israeli-US military operation against Iran could be a positive factor for Bitcoin and the entire crypto market. They believe the escalation in the Middle East has become the catalyst the market had been expecting in recent months. They view the decline in Bitcoin prices amid news of the conflict as a normal correction within the

Bitcoin is experiencing a “crisis of faith” after falling more than 40% from its all-time high and its market capitalization shrinking by approximately $1 trillion, according to analysts surveyed by Bloomberg. They estimate the market sees no new growth catalysts. Experts note that Bitcoin is facing increasing competition from alternative assets. Gold is strengthening its position as a safe haven, stablecoins are dominating payments, and prediction markets, including Polymarket, are attracting speculative capital. Analyst Noelle

Experts from the blockchain platform Arkham Intelligence have published a study on the distribution of BTC among the largest holders, assessing the concentration of assets among individuals, companies, exchanges, and government agencies. According to Arkham data, the largest Bitcoin holder remains the anonymous creator of the original cryptocurrency, Satoshi Nakamoto. Analysts estimate that wallets linked to him hold approximately 1.1 million BTC, making him the largest individual owner. Among publicly identified wallets, the Binance cold

Trump Media, the company owned by US President Donald Trump and the owner of the social network Truth Social, has filed documents with the US Securities and Exchange Commission (SEC) to register two cryptocurrency exchange-traded funds (ETFs). The first fund, called the Truth Social Bitcoin (BTC) and Ether (ETH) ETF, aims to track the combined performance of the two largest cryptocurrencies by market capitalization. The fund promises rewards for staking Ether. The second fund, the

Elon Musk’s Tesla, the largest American electric car manufacturer, announced that it did not buy or sell any coins from its Bitcoin holdings between October and December. The company currently holds 11,509 coins, the same as the previous months. Although the Bitcoin supply remained unchanged, the fall in the price of the leading cryptocurrency from $114,000 to $88,000 over the past three months has resulted in a loss of approximately $239 million, Tesla reported. With

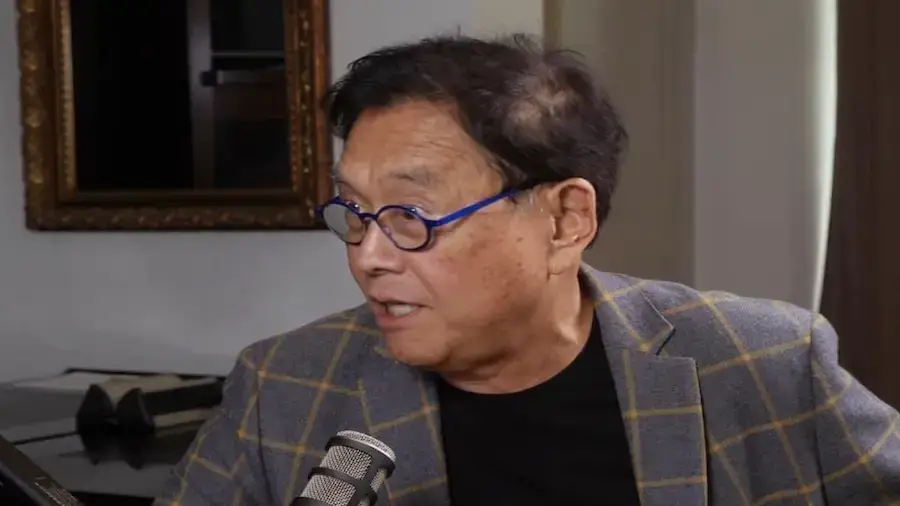

Robert Kiyosaki, author of the personal finance book “Rich Dad, Poor Dad,” said he was wrong to sell his Bitcoin and advised other investors not to hold their money in US dollars, but to invest in gold, silver, and the first cryptocurrency. The writer recounted his visit to the Vancouver Resources Investor Conference (VRIC), where issues related to financial education and precious metals investing were discussed. Kiyosaki said that, contrary to rumors, he hadn’t sold

GoMining, a platform that offers mining power tokenization through non-fungible tokens (NFTs), is partnering with watchmaker Jacob & Co. to release a mechanical watch with a Bitcoin mining monitoring feature. The announced kit, called the Epic X GoMining, consists of a Jacob & Co watch and a digital miner with a capacity of 1,000 terahashes. To use the mining device, you need to activate your GoMining account, which allows you to manage your activity on

Economist and crypto skeptic Peter Schiff has urged Bitcoin investors to reconsider their investment in the cryptocurrency amid rising gold and silver prices. The economist stated that volatility in the currency, bond, and digital asset markets is creating conditions favorable for investing in traditional stores of value, namely precious metals. Schiff noted new record highs reached by gold and silver: $4,967 and $99.24 per ounce, respectively. Meanwhile, Bitcoin is trading at $88,000—approximately 30% below its

The Bitcoin market has come under the control of new major investors, each holding over 1,000 coins over the past few months. These “new whales” are the most sensitive to fluctuations in the price of the leading cryptocurrency, according to experts from the CryptoQuant platform. It was these “new whales” who suffered the heaviest losses during the recent market downturns. They were forced to sell on price declines and exploit short-term gains to exit their

Bitcoin risks repeating the 2022 bearish scenario and facing a decline if it fails to consolidate above the key $101,000 level, according to experts at the CryptoQuant platform. Although Bitcoin has risen 21% since November 2025, from $80,500 to $97,900, this is a “bear market rally” and not the start of a sustainable recovery, analysts say. “A similar scenario unfolded in 2022 during the previous bear market. Bitcoin’s price fell 27% after crossing the 365-day