NEWS Feed

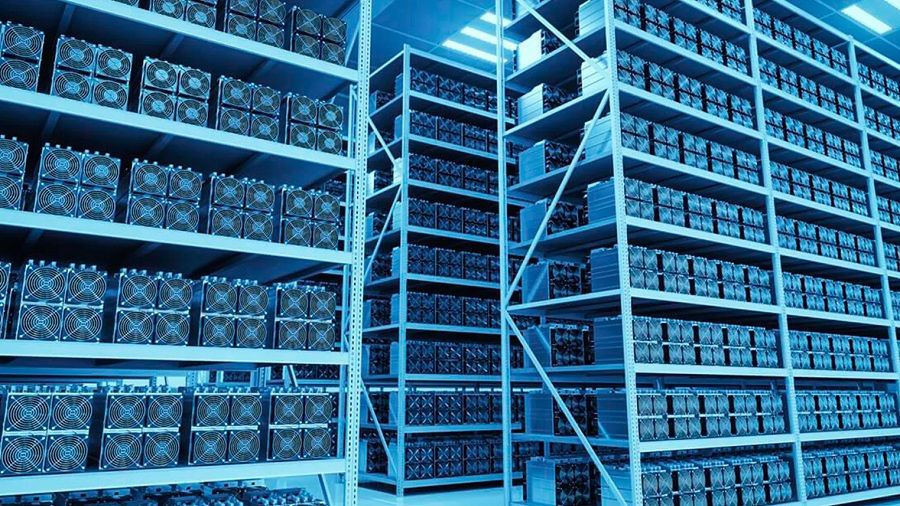

The average hash rate of the Bitcoin network has fallen by 30%, from 230 Eh/s to 155 Eh/s. Such a significant drop in the indicator is connected with the ongoing bad weather in the United States, due to which many miners turned off the equipment. The United States remains the leader in terms of the contribution to the hashrate of the network of the first cryptocurrency – on average, American miners generate 37% of the

The island nation of Palau and the cryptocurrency company Ripple Labs announced the start of a joint project to create a state digital stable currency. Palau President Surangel S. Whipps said in an interview with Bloomberg that a joint IT team from the island nation and Ripple Labs are working to explore opportunities to create a “national stablecoin.” Discussing digital asset strategy, the president of the archipelago of more than 500 islands, explained that such

It’s not every day that you come across a broker with a vision to make a positive impact beyond the world of finance. CedarFX, however, is changing that perception. The leading online broker has recently launched a revolutionary Eco Account option to its traders, making it the first-ever Eco-conscious broker to exist! Through their various account options, CedarFX is dedicated to helping traders reach higher by offering ultra-high leverage and low spreads. Traders can get

The developers of the second layer solution Polygon announced the launch of the second test network with support for zkEVM technology. The next step should be to launch the main network of the project with zkEVM support. The zkEVM technology is designed to allow a significant increase in Ethereum throughput and, according to the developers, thanks to the Recursion update, the scaling “will be exponential”. The technology is based on zero-knowledge proofs and has become

One of the largest publicly traded cryptocurrency mining companies in the US, Core Scientific, plans to file for creditor protection in Texas bankruptcy court. According to CNBC, Core Scientific is unable to pay off debt for rented mining equipment despite generating positive cash flow. Because the funds at the disposal of Core Scientific are not enough to service the growing debt, the company plans to file for protection from creditors in the bankruptcy court of

Building a Diverse Trading Portfolio A look at the importance of risk mitigation through diversifying your portfolio. When it comes to online trading, portfolio diversification is a powerful tool used by investors to mitigate risk. This strategy involves investors holding multiple assets across varying markets, industries and geographical jurisdictions in order to spread their exposure and decrease the risk of loss due to one industry collapsing. The Benefits of a Diversified

Lending platform Celsius informed potential buyers that the deadline for submitting bids for participation in the auction has come to an end and the sale of assets is scheduled for January 2023. The Bankruptcy Court for the Southern District of New York has set an auction for the sale of Celsius assets on January 10. The company said it has already received more than 30 offers with various options for acquiring its assets or business

Cryptocurrency exchange Binance US has offered the best conditions for the buyback of Voyager Digital assets – the transaction should be closed by April 18, 2023. The US subsidiary of the Binance cryptocurrency exchange has won a tender to acquire the assets of a bankrupt crypto lender worth more than $1 billion. Voyager said that Binance US’s offer has been the best so far. A buyback date has not yet been set, but Binance decided

Representatives of the Coinbase crypto exchange, referring to the user agreement, demanded that the dispute in the lottery case with Dogecoin be considered in private arbitration, and not in general court order. But the US court refused the trading platform. Former clients filed a lawsuit against the American crypto exchange. Users claim to have been scammed into paying $100 or more to enter the Coinbase Dogecoin contest. Last June, the platform was raffling off $1.2

It’s not every day that you come across a broker with a vision to make a positive impact beyond the world of finance. CedarFX, however, is changing that perception. The leading online broker has recently launched a revolutionary Eco Account option to its traders, making it the first-ever Eco-conscious broker to exist! Through their various account options, CedarFX is dedicated to helping traders reach higher by offering ultra-high leverage and low spreads. Traders can get