The CEO of Factor compared the current market trend to the Bitcoin cycle that the first cryptocurrency made in 2016. The fall in value on August 5, 2024, corresponds, according to the businessman, to a similar fall eight years ago, after which bullish growth began.

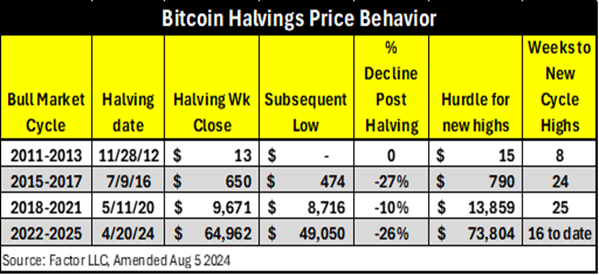

Peter Brandt analyzed several market indicators, including the level at which trading closed a week after Bitcoin’s halving. He then turned his attention to the post-halving drawdown and support levels before the first cryptocurrency’s rate began to rise.

The businessman recalled that the second Bitcoin halving took place in July 2016, and before that the BTC price was $770. A week later, the rate of the first cryptocurrency fell to $650, and the drawdown was 27%. After that, the rate recovered to $790, and then a bullish cycle began, which lasted a year, the expert recalled.

According to Peter Brandt, there is a certain parallel between the previous phase and the current one. A week after the halving in April 2024, the Bitcoin rate was $64,960, and on August 5, the asset’s value fell to $49,100. The drawdown was 26%.

In the 2016-2017 cycle, the first cryptocurrency needed twenty-four weeks to update the maximum. In the 2024 cycle, sixteen weeks have already passed, the expert noted. Earlier, Peter Brandt stated that if the Bitcoin price follows the trajectory of past bull cycles after the halving, it will reach $130,000–$150,000 by the end of August 2025.