Tether, the issuer of the first USDT stablecoin by capitalization, has released its results for the first quarter of 2023. According to the report, the company’s net profit amounted to $1.48 billion.

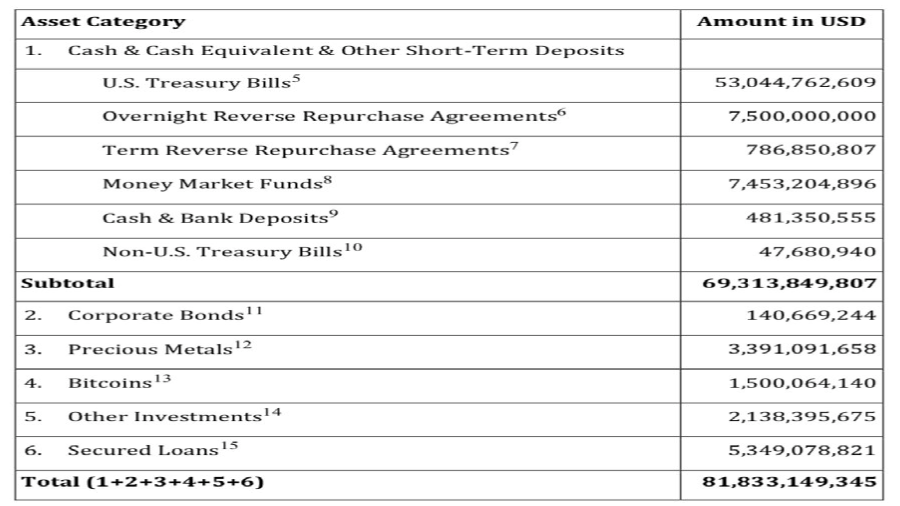

The total assets of the company reached $81.8 billion, of which about $2.44 billion was declared as excess reserves to support the liquidity of the USDT stablecoin. Most of Tether’s reserves are in US Treasury bills, according to audit firm BDO Italia.

In addition, Tether owns $1.5 billion in bitcoin reserves (BTC) (approximately 2% of total assets) and $3.4 billion in gold reserves, which is about 4% of total total assets.

“We monitor the risk-adjusted performance of all assets in our portfolio on an ongoing basis and make necessary adjustments as the overall economic environment changes,” Tether CTO Paolo Ardoino commented on the report.

In a quarterly report, Tether disclosed data on its reserves in BTC and gold for the first time. Although the company’s gold reserves exceed the cryptocurrency reserves by 2 times, the very fact of reserving funds in bitcoins caused bewilderment among some part of the crypto community.

“It turns out that Tether trades bitcoin. Imagine a stablecoin backed by highly volatile assets that can be manipulated. Tether can overprice BTC to make up for any shortfall,” tweeted user Bitfinex’ed.

According to the latest USDT stablecoin issuer certification data for February 2022, the company’s consolidated assets exceeded its consolidated liabilities by $140 million.