Part of the world’s largest family-owned private banking group, LGT Bank, with the support of the Swiss bank SEBA, has launched a cryptocurrency investment program.

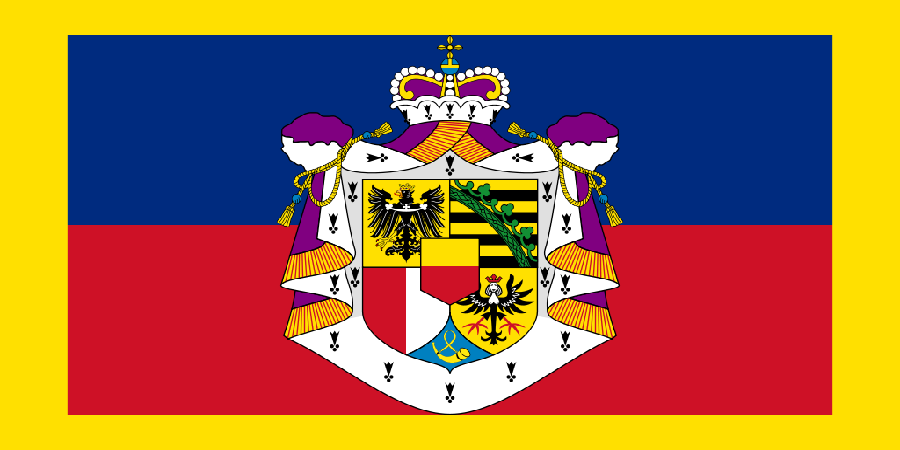

The LGT Group is owned by the Princely House of Liechtenstein. The bank announced the conclusion of a partnership agreement with SEBA, the condition of which will be “acting as a cryptocurrency broker and investment services operator.”

At the initial stage, from May 2022, “direct investments” in two crypto assets — bitcoins and ethers — will be available to LGT Bank customers. Mandatory conditions – clients must “reside in Liechtenstein or Switzerland, and also be classified as professional investors or be clients of an external asset manager.”

SEBA Head of Client and Technical Solutions Matthias Schütz said that “the parties are working to expand the offer and increase its availability”, and are also “in talks to add more variety of coins and investment rates.”

In early March 2022, the authorities of the Swiss city of Lugano announced the legalization of a limited list of cryptocurrencies – BTC, USDT and the city’s own token LVGA – as legal tender. The authorities said that citizens and companies in Lugano will be able to use these three assets to pay for all goods, services and taxes in the near future. When making transactions, cryptocurrencies will be automatically converted into Swiss francs through a third-party intermediary.