With the US tax filing deadline approaching, Coinbase is launching a service that will allow customers to analyze and file cryptocurrency transactions with the IRS.

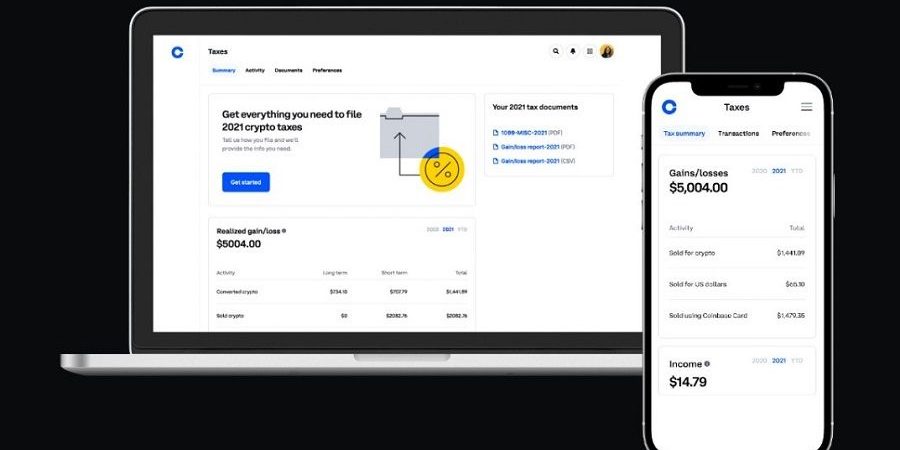

Cryptocurrency exchange Coinbase announced on its blog the launch of a new service that will display all taxable user activity, including short-term and long-term profits and losses, in one place. Previously, cryptocurrency holders had to manually calculate how much they earned from trading cryptocurrencies and what tax rate was applied to their profits.

The statement says that if users have sent or received cryptocurrencies from Coinbase Pro or external wallets and the exchange does not have this information, then customers can use CoinTracker to aggregate their transactions on Coinbase, other exchanges, wallets and DeFi services and receive free tax reports on 3 000 transactions.

The Internal Revenue Service (IRS) said last week that NFT investors were evading billions of dollars in taxes. At the same time, the regulator did not provide clear rules for the taxation of collection tokens. Earlier, the IRS said that the number of crimes related to cryptocurrencies has increased significantly, with $3.5 billion confiscated in the last fiscal year.

Recall that last year, US President Joe Biden approved a bill clarifying the expansion of taxation of cryptocurrencies, which will bring $ 28 billion in taxes to the treasury. From its introduction, centralized cryptocurrency exchanges like Coinbase will become brokers and will have to report customer transactions directly to the IRS.