PLATINUM

LIVE Forex signals

About PLATINUM FOREX signals:

After thousands of market situations and testing different methods of analysis we found that the safest way to trading is the entry into LONG-TERM deals – LONG-TERM trading. That means getting into a bargain and the minimum time to hold it before we close it is 1 day.

Our Platinum signals are LONG-TERM signals.

According to this model of trading, the profits that are received are large and with the right Risk Management and position control the losses can be reduced drastically.

The analyzes that are made for each long-term Platinum signal are on Daily graphics (scenarios developing on D1 chart), and inputs to signal transactions are determined based on the H4 chart. The ratio of Take profit to Stop loss is 2: 1 – 3: 1 – 4: 1.

We advice you to trade our signals with 1% to 3% of the capital for each traded Platinum signal.

Unlike our VIP signals(where the order to the broker is Market Execution all the time) at Platinum you can get signals with “Pending Orders”. The idea of these pending orders is to buy or sell an instrument at a much more favorable price (in buy / sell limit orders) and to minimize the stop loss levels/or automatically switch to a break, impulse or created momentum and take advantage of the rapid movement of the price instantly with buy / sell stop pending order.

How can we control our deal in Platinum signal?

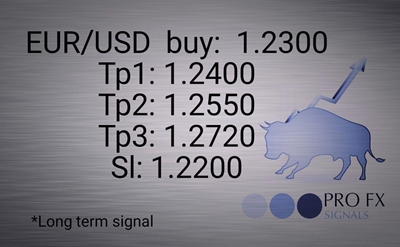

Let’s say we have such an signal on EUR/USD

Signal for example – EUR / USD buy 1.2300

TP1: 1.2400

TP2: 1.2550

TP3: 1.2720

SL: 1.2200

Assume that after our Risk Management of a $ 10,000 account, 1% of our risk is 0.10 lots. We suggest that you divide these 0.10 lots total volume into 3 different volumes that will be allocated as 3 orders for 3 take profits. That is, when the signal comes out we must enter 3 orders/deals respectively:

- First order buy at 1.2300 with 0.06 lots – set take profit at TP1: 1.2400

- Second order buy at 1.2300 with 0.03 lots – set take profit at TP2: 1.2550

- Third order buy at 1.2300 with 0.01 lots – set take profit at TP3: 1.2720

- Stop Loss set at 1.2200

The idea is to protect our funds and to control the position cleverly.

If the price in the worst case falls against us and hit our SL – we will be at a loss of $100 (or 100 pips / or 1% of our capital). Assume the price goes up and reaches TP1-1.2400 – we entered 3 deals (0.06 lots, 0.03 lots, and 0.01 lots or a total of 0.10 lots). When reaching this price(1.2400), we are making a profit of 100 pips, or in other words $100. Once it’s reached the first TP we have to close the first and the largest deal – the one with 0.06 lots (we are making a profit of $60 from the largest deal/position – the first of 3). Once we have closed the first one, there are two more trades going on and we can immediately move their stop loss(both positions) at the entry price (the price we have entered in transactions) – 1.2300 – whatever happens from here on with our signal, we will be at the minimum secure profit of $60. We give the field of development of the two remaining positions/deals by waiting for the 2nd position with 0.03 to reach the target TP2-1.2550 and 3rd open position with 0.01 to reach TP3-1.2720. Assume the price jumped to TP2-1, 2550 there closing our second deal with 0.03 lots of profit of 250 pips or + $75. We have another open position with 0.01 lots that goes on profit and which has TP on TP3-1.2720, we can also close manually or wait for the price to rise to 1.2720. If the 3rd TP is executed, we will be on a profit of the 3rd position + 420 pips or $42. If we wait the whole 3 positions to hit their TPs, the total score will be + $177 with a minimum risk of 1% of the capital.

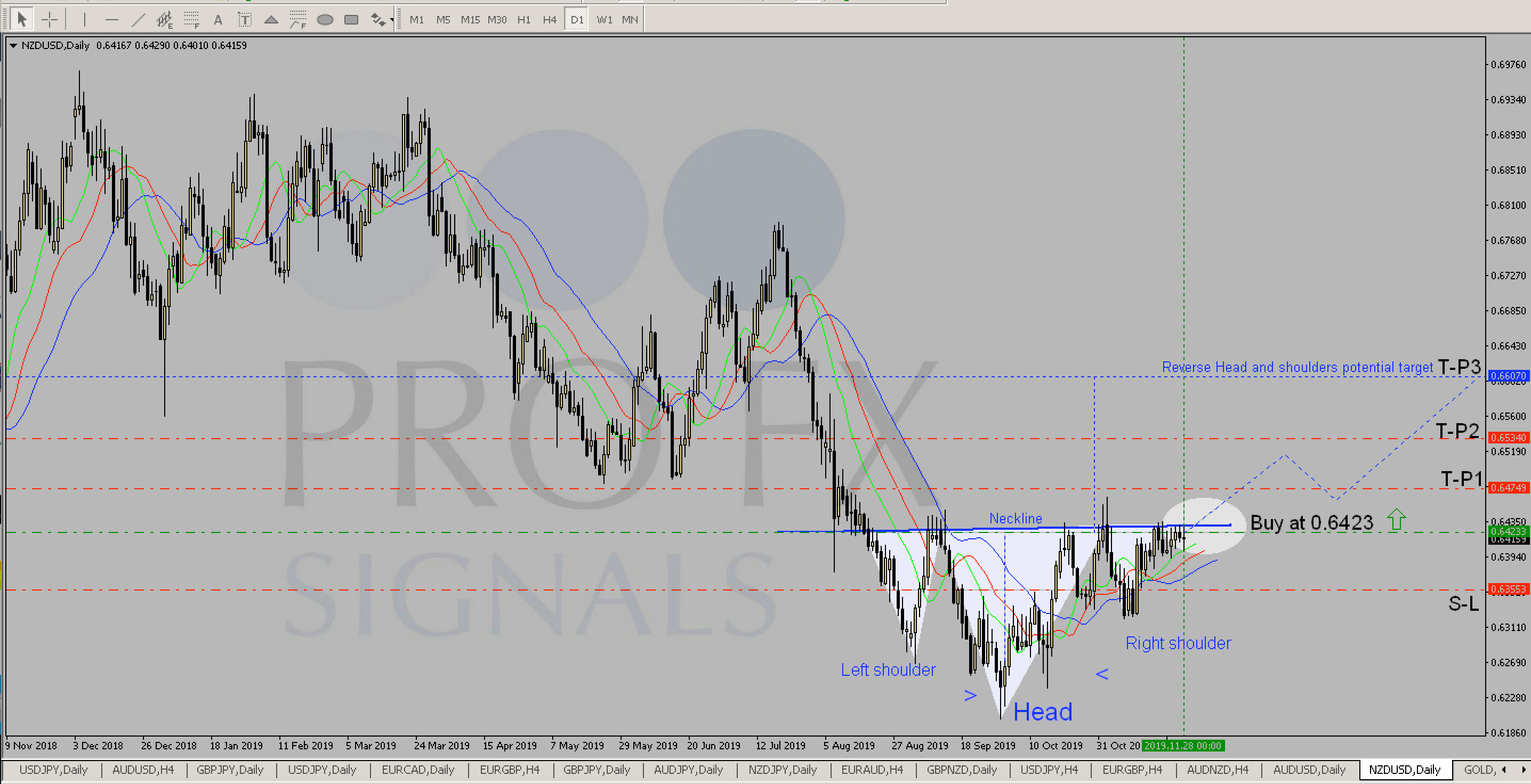

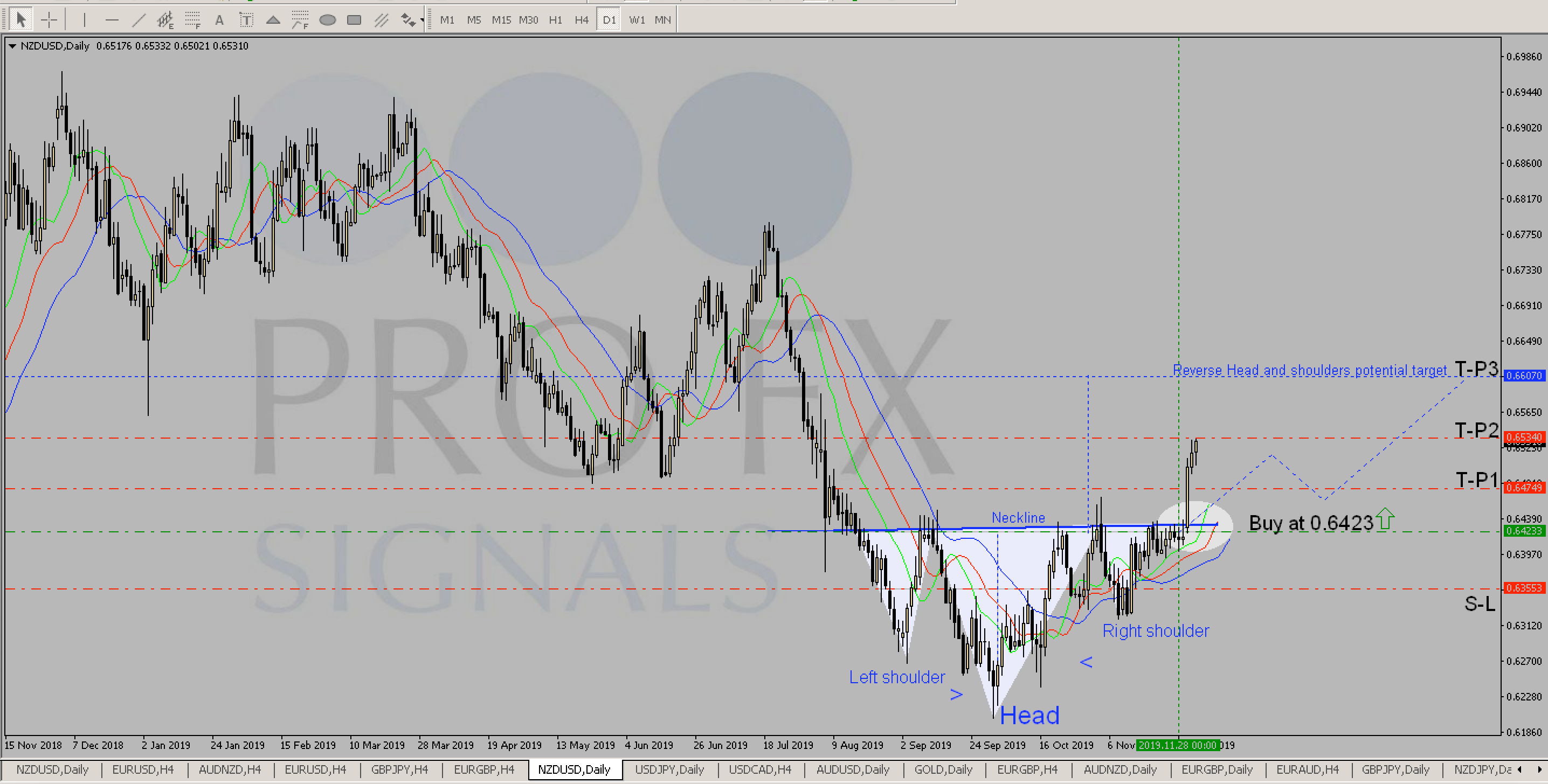

Example signal from our Platinum channel – NZD/USD buy at 0.6423

TP1: 0.6474

TP2: 0.6534

TP3: 0.6607

SL: 0.6355

First order buy at 0.6423 with 0.06 lots – set take profit 1(TP1) at: 0.6474

Second order buy at 0.6423 with 0.03 lots – set take profit 2 (TP2) at: 0.6534

Third order buy at 0.6423 with 0.01 lots – set take profit 3(TP3) at: 0.6607

Stop Loss set at 0.6355

Once it’s reached the first TP(TP1) at 0.6474 we have to close the first and the largest deal – the one with 0.06 lots. Once we have closed the first one, there are two more trades going on and we can immediately move their stop loss(both positions) at the entry price(entry point – the price we have entered in transactions – 0.6423). Whatever happens from here with our signal, we will have a minimum secure profit.

The price reach TP2 at 0.6534 – there, we need to close our second trade with 0.03 lots. We have another open position with 0.01 lots that goes on profit and which has TP on TP3: 0.6607, we can also close manually or wait the price to reach 0.6607 level.

Of course, this is only advice to you for proper position management and everyone decides how they will control the whole deal.

If you want to receive our signals directly on your mobile phone or PC with sound notification, you need to install the Telegram app