The developer of the eCash cryptocurrency, Bitcoin’s predecessor, is working with the Swiss National Bank (SNB) on the central bank’s digital currency privacy project.

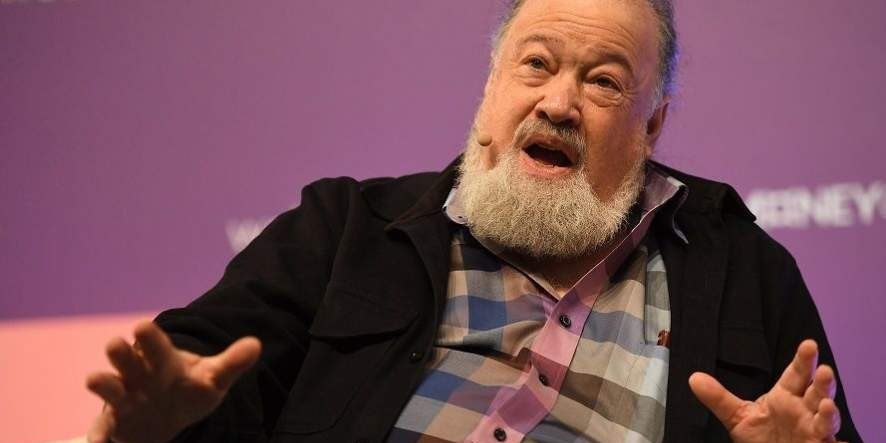

According to David Chaum, his Tourbillon technology will ensure the anonymity and quantum invulnerability of the central bank’s digital currencies. The system is scalable because it “uses an architecture compatible with, but not based on, distributed ledger technology.”

Chaum’s blind signature concept avoids trade-offs between cyber resilience, scalability, and user privacy. The industry veteran believes that the US and Europe will definitely face a choice when launching a CBDC:

“Save or not the right to privacy that distinguishes our democratic society based on human rights from China? Or will we have the same system of digital currencies of the Central Bank as in China?”

The developer claims that the eCash 2.0 technology he created is a payment system with built-in privacy and anti-phishing protection.

“For me, it is incredibly ironic that payment privacy, which I worked on 40 years ago, has become a key difference between East and West,” Chaum said.

The creator of eCash considers it important to prove that the CBDC can ensure the privacy of users and that no government can refuse this solution, as it resembles the digital yuan model.

Last year, former NSA technical specialist Edward Snowden said that any digital currencies of the Central Bank are a conspiracy against human society, distorting the principles of real cryptocurrencies.