President of the American company Noll Historical Consulting Franklin Noll tried to prove with an example from the history of the US Treasury that cryptocurrencies can be recognized as both a means of payment and a security.

The financial historian’s statement came in the wake of the ongoing debate about the status of cryptocurrencies. The final generally accepted answer to the question of whether a cryptocurrency is a security or not does not yet exist. Franklin Knoll, in an article published last week, argues that the US government has twice released tools that perform both functions at the same time.

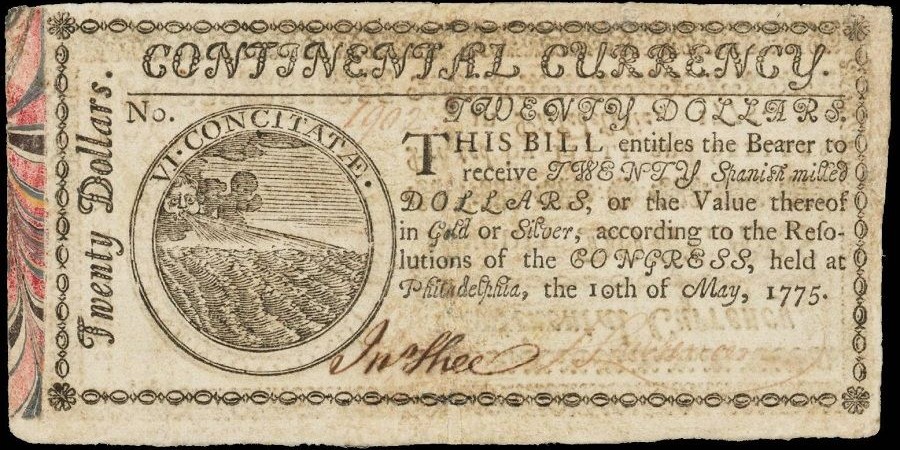

The Continental dollar became infamous in the 18th century as a failed attempt to finance the Revolutionary War by issuing money. In addition to being used as currency, it was proposed to consider continental dollar banknotes as securities.

Referring to the research of Dr. Farley Grubb, Knoll argues that the Continental dollar was, by and large, zero-coupon bonds with small denominations. However, later the US Congress changed the original terms of redemption, depreciating these securities.

In addition to the continental dollar, the head of Noll Historical Consulting recalled the paper interest-bearing notes of the Civil War era issued by the US Treasury.

According to Knoll, these notes were intended “to act as a currency and as a security.” However, unlike the failed Continental dollars, interest-bearing notes were a success.

These bonds, with a face value of only $10, paid a 5% annual rate. The holder received these percentages when he handed over the banknote to the US Treasury. The banknotes were a success and were fully redeemed, as promised by the state.

US Securities and Exchange Commission (SEC) Chairman Gary Gensler recently failed to answer whether Ethereum is a security. At the same time, the SEC has been pursuing Ripple since 2020 – the company’s management is accused of selling unregistered securities worth $1.3 billion. In this case, we are talking about trading in the XRP cryptocurrency. On the other hand, back in 2019, the Commission made it clear that it does not consider bitcoin a security. Recently, the head of FTX, Sam Bankman-Fried, said that the properties of some crypto assets make them more like just securities.