Let us do the hard work for YOU and make sure it doesn’t happen again – ever.

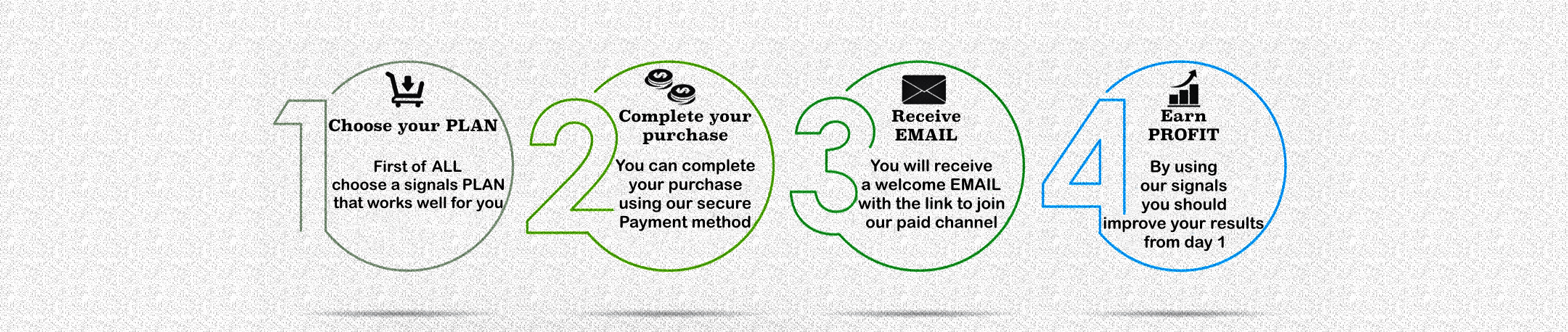

Choose your subscription plan and we will show you the best trading opportunities!

Select plan

VIP 1 Month

44 EUR

VIP channel!

- Short term signals

- 5 – 7 signals daily

- Signals for Currencies

- 1000 – 2000 pips/month

- Sound Alerts

- Signals by Telegram/Email

- 24X7 Email Support

Select

VIP 3 Months

15 eur/month

VIP channel!

- Short term signals

- 5 – 7 signals daily

- Signals for Currencies

- 1000 – 2000 pips/month

- Sound Alerts

- Signals by Telegram/Email

- 24X7 Email Support

Select

VIP 6 Months

9 eur/month

VIP channel!

- Short term signals

- 5 – 7 signals daily

- Signals for Currencies

- 1000 – 2000 pips/month

- Sound Alerts

- FXPROFITSIGNALS EA

- Signals by Telegram/Email

- 24X7 Email Support

Select

VIP 12 Months

5 eur/month

VIP channel!

- Short term signals

- 5 – 7 signals daily

- Signals for Currencies

- 1000 – 2000 pips/month

- Sound Alerts

- FXPROFITSIGNALS EA

- Signals by Telegram/Email

- 24X7 Email Support

Select