Payment details

PayPal

Stripe

Promo Code:

Sign Up

Sign Up

Sign Up

Sign Up

FX PROfit signals provide you with the best free forex signals. Join us for Free!

PayPal

Stripe

Promo Code:

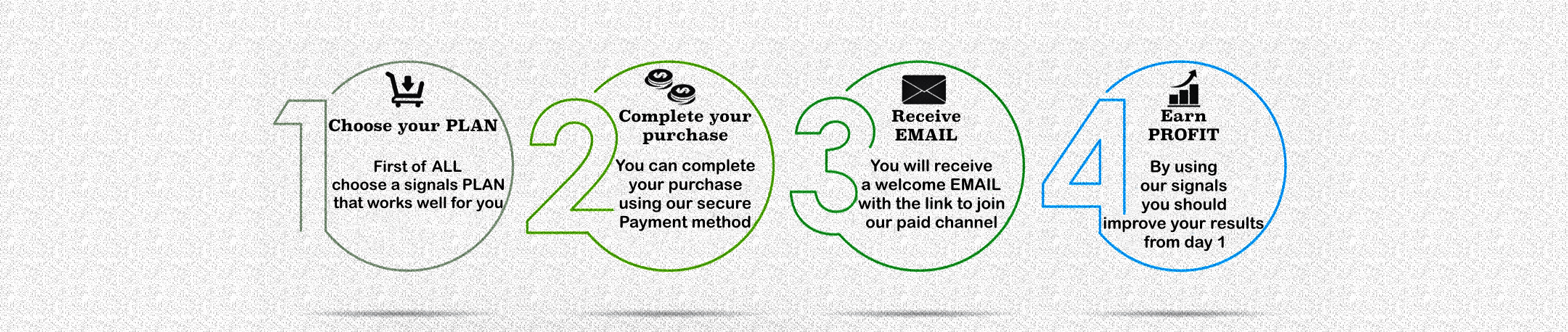

After you make a payment, we will send you a link for join our paid channel in Telegram

If you don’t receive an email in your inbox folder, please check in your spam folder

A value added tax (VAT) may be included in the final price you have to pay!

FX PROfit Signals is required to charge VAT (value added tax) on all services delivered to destinations in EU countries in accordance with the tax laws governing members of the European Union.

The VAT rate is in accordance with local legislation. As a result, the VAT amount is subject to change per the guidelines of each country’s tax authority.