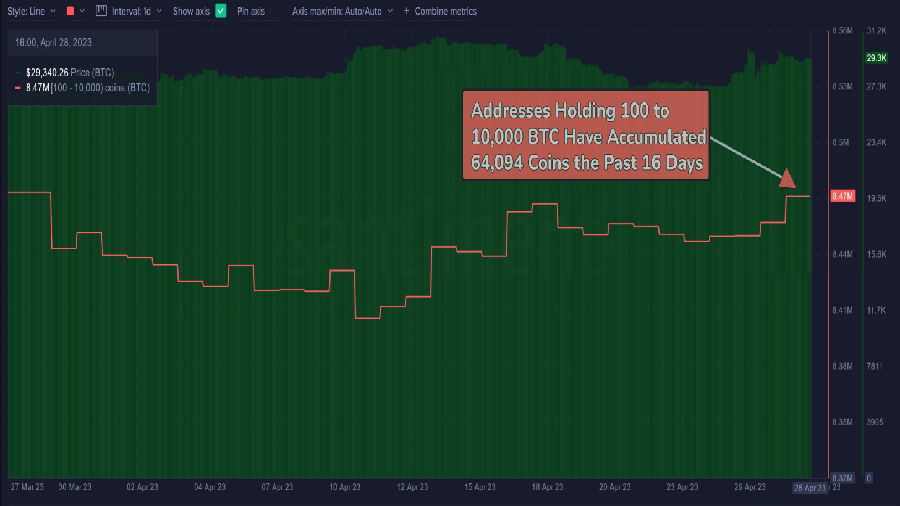

According to Santiment’s April reporting data, large bitcoin investors increased their asset holdings in the first cryptocurrency by 64,000 BTC (about $1.8 billion).

In their report, Santiment analysts note that bitcoin whales set their sights on replenishing BTC reserves, despite the opinion that the final direction of the asset’s price movement has not yet been formed. Large investors still adhere to the belief about the prospect of growth in BTC.

Illustrating their observations, Santiment experts report: the activity of bitcoin whales gradually decreased from the end of March to the first ten days of April. Then the price of BTC moved in a sideways trend, and then rose sharply, reacting to approaching the $30,000 mark.

In an interview with CNBC, James Lavish, managing partner of the Bitcoin Opportunity Fund, said that “BTC touching the $30,000 level has activated small speculators on short positions, and large investors are trying to get ahead of them.”

The head of foreign exchange research at Standard Chartered Bank suggested that BTC could rise in price by about $20,000 if the US defaults on its public debt obligations.