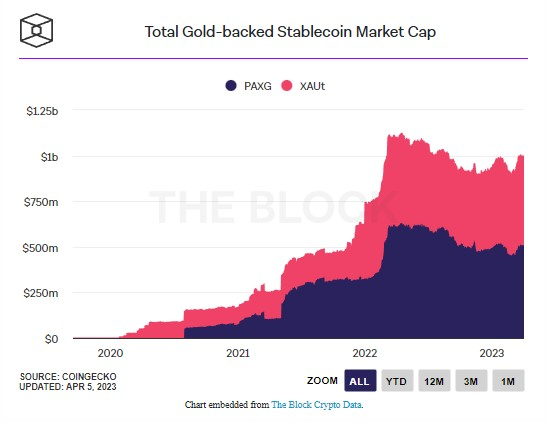

The total capitalization of tokens linked to the price of gold has reached $1.02 billion. There are two major players on the market, PAX Gold and Tether Gold, whose capitalization occupies a share of 99% of tokenized gold.

Both tokens are options for stablecoins, however, their price is not pegged to fiat currency, but to the market value of gold. PAX Gold (PAXG) has a market capitalization of $523 million, while Tether Gold (XAUt) has a market capitalization of $499 million. The closest competitor, Perth Mint Gold (PMGT), has a market capitalization of just $2.46 million.

The increase in the capitalization of “golden stablecoins” is not surprising – the value of the underlying asset is growing. Now an ounce of the precious metal is selling for $2,048, which is the highest value in the history of trading.

Behind the PAX Gold tokens is the Paxos Trust Company from New York. Tether Gold is issued by Tether. Interestingly, the distribution of gold-pegged stablecoins across platforms varies. PAXG has the highest trading volume on Kraken and Binance, while Bitfinex is dominated by XAUt traders. Both tokens are also traded on the Uniswap decentralized platform, however, the liquidity there is noticeably lower.

A capitalization of $1 billion is not the maximum for the tokenized gold market. In the spring of 2022, the figure slightly exceeded $1 billion, however, along with the fall of the cryptocurrency market, the capitalization of gold stablecoins also decreased.

A recent study by the Central Bank of the Russian Federation showed that Russians are not too fond of investing in precious metals – even cryptocurrencies turned out to be more popular.