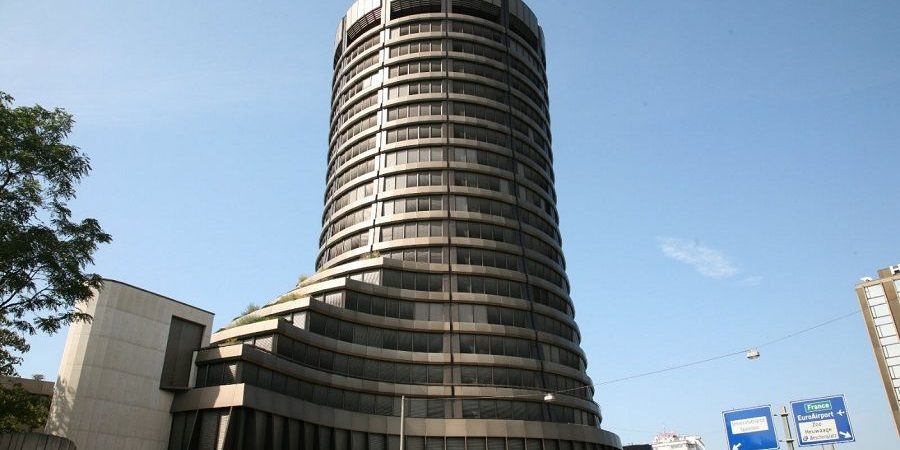

The Basel Committee on Banking Supervision (BIS), after the collapse of the UST stablecoin, stated that in order to maintain financial stability, banks should have a limit on the holdings of unsecured crypto assets.

The riskiest class of crypto assets, which includes non-backed conventional reserves or asset-pegged stablecoins, will be capped at 1% of Tier 1 capital, the document says. For large banks like JP Morgan Chase, 1% Tier 1 capital can be in the billions of dollars.

The original plans of BIS implied that the bank could hold risky cryptocurrencies, conditionally, for $100 – subject to a capital of $100. Which essentially excluded any incentive for the bank to participate in crypto-investments.

The new BIS proposal implies that the 1% cap will apply to fiat cryptocurrencies like bitcoin and to assets like algorithmic stablecoins that are backed by other cryptocurrencies. For example, if a bank holds 0.6% of capital in algorithmic stablecoins and 0.5% in bitcoins, it violates the restriction of the European regulator.

The Committee is awaiting comments and suggestions from the banking community until the end of September and promises that until this date it will closely monitor the rapidly changing and unstable cryptocurrency market.

Following the collapse of USTerra, the Basel Committee on Banking Supervision said it would launch a platform to track stablecoins and DeFi projects.